JUST Report

JUST Capital’s Quarterly Review of Stakeholder Performance – Q4 2023

- More Reports

- View all JUST Reports

This report was written by Mona Patni, Director of Quantitative Research & Analytics.

2023 was a strong year for U.S. equities as measured by the S&P 500 index. For 2023, the S&P 500 posted a 24.23% return (26.44% with dividends), which made up for 2022’s loss of 19.44% (-18.11%). The rebound has been driven by several factors, but chief among them have been a return to growth stocks, a massive runup in technology names partly due to the craze around artificial intelligence (AI), and a long-awaited Federal Reserve dovish pivot that sets up interest rate cuts in 2024.

At the sector level, eight sectors gained for 2023, compared with one in 2022, with three up over the past two years amid solid consumer spending and steady economic growth. Information Technology, Communication Services, and Consumer Discretionary were the three biggest winners in 2023, all of them up more than 40% for the year. Unlike cyclical and growth-oriented sectors, defensives did not fare as well. Utilities, Energy and Consumer Staples are some of the poorest performers of 2023:

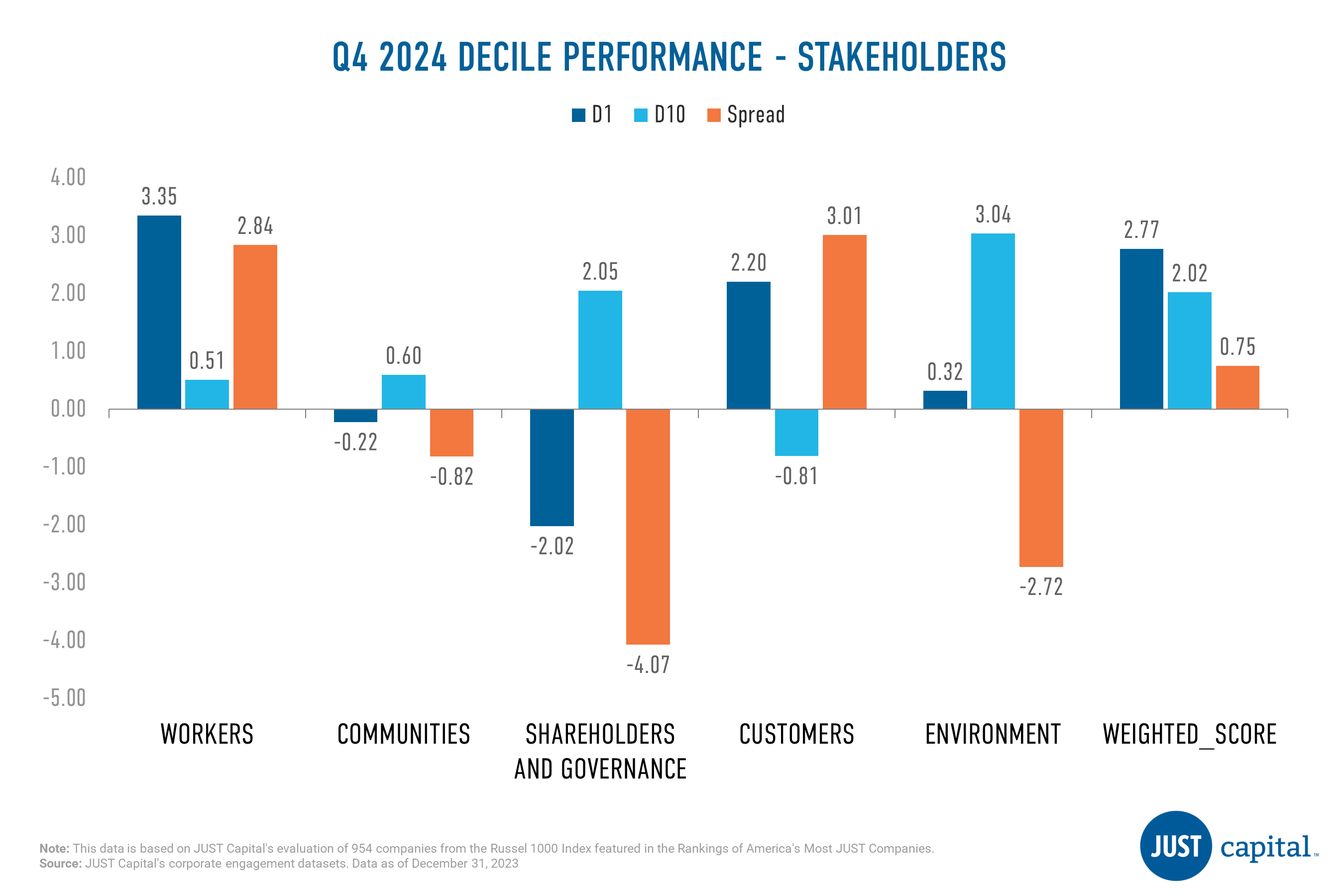

JUST Capital found that two of the five stakeholders we track delivered positive performance in Q4 2023. Over the longer term from January 2018 to December 2023, the leaders in corporate stakeholder performance across all five stakeholders have outperformed the laggards by 66.6% as measured by JUST Overall Score.

In Q4 2023, the Customers stakeholder delivered the strongest performance over this period with a long-short spread of 3.01%, while the Shareholders & Governance stakeholder fared most poorly at -4.07%. Within the Workers stakeholder, outperformance was driven by the top decile whereas for Customers stakeholder outperformance was driven by both deciles. For the Communities and Shareholders & Governance stakeholders, underperformance was driven by both deciles whereas for Environment stakeholder negative contribution was driven by bottom decile.

JUST Capital’s Overall Weighted Score takes into account the 20 core Issues determined through our annual survey research – including paying a living wage, creating a diverse, inclusive workplace, and helping combat climate change – across key business stakeholders: Workers, Communities, Shareholders & Governance, Customers, and Environment. This Overall Weighted Score had a positive long-short spread of 0.75% over the period ending December 29, 2023.

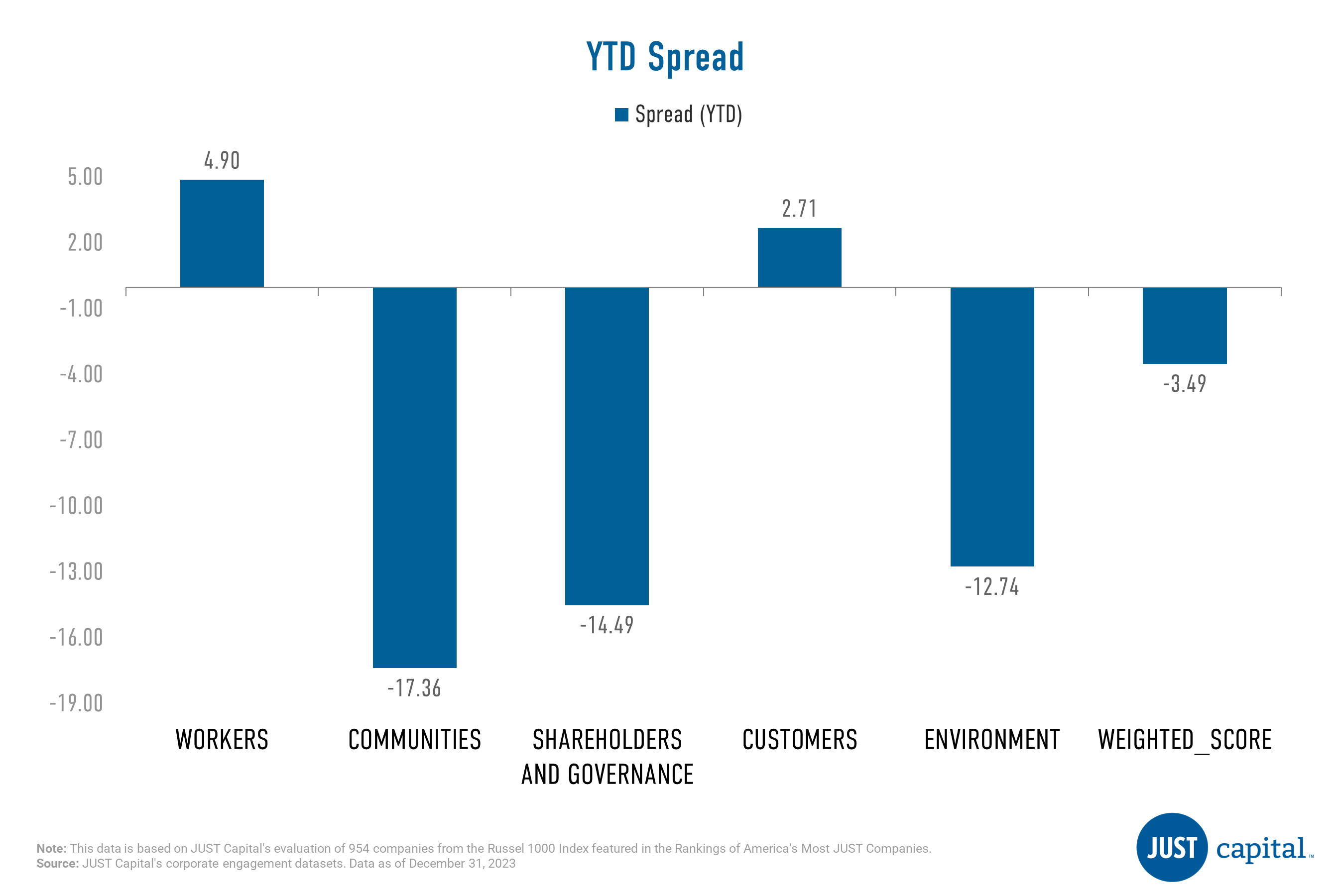

Shown below is the Year-to-Date (YTD) performance, which is quantified by the spread between the top and bottom deciles for each stakeholder as well as the overall weighted score. Year-to-date, the Workers stakeholder has delivered the strongest performance and the Communities stakeholder has delivered the weakest.

Workers

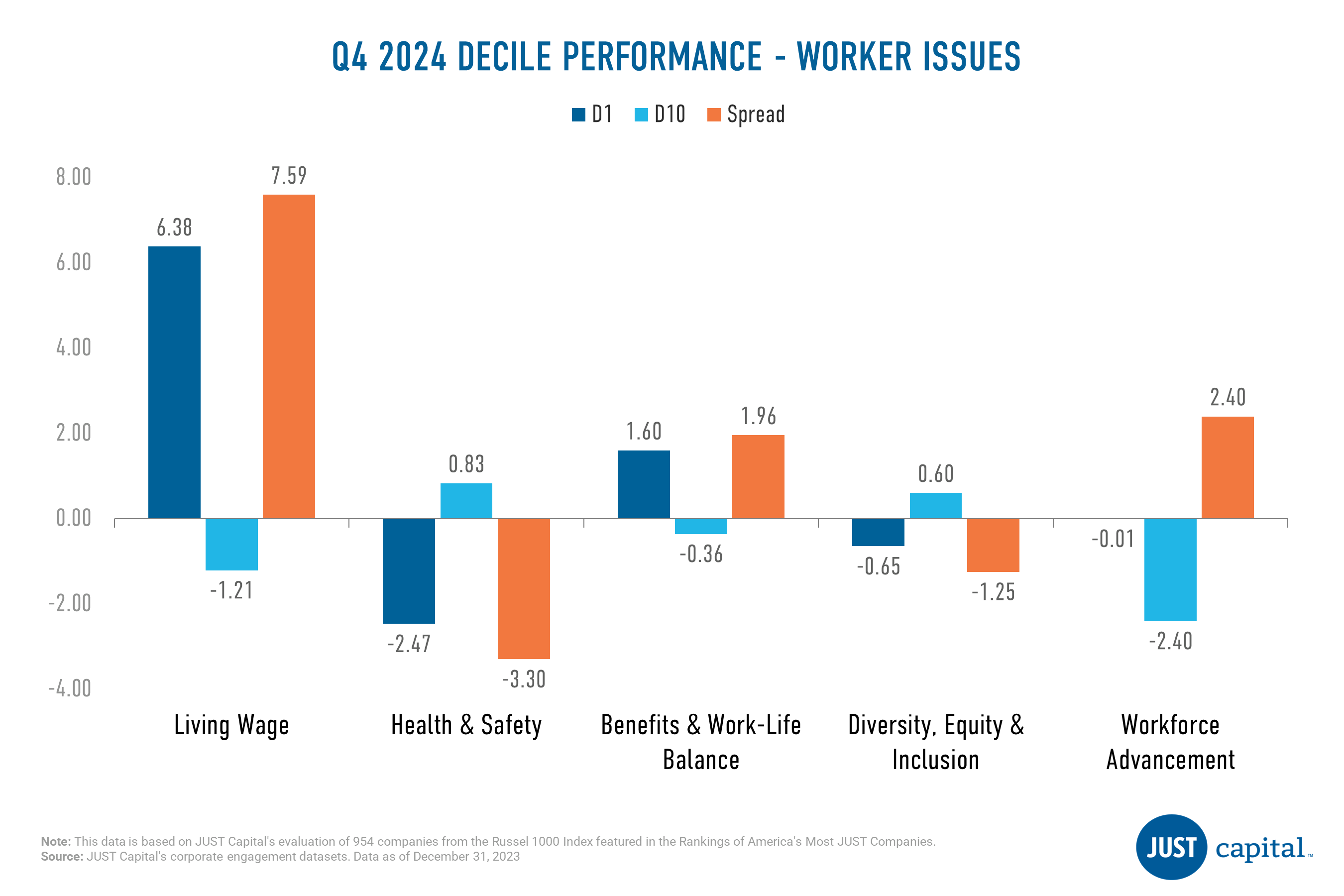

The Workers stakeholder measures a company across five Issues:

- Living Wage

- Health & Safety

- Benefits & Work-Life Balance

- Diversity, Equity, and Inclusion

- Workforce Advancement

In Q4 2023, we saw three out of five issues deliver positive performance, with Living Wage and Workforce Advancement Issues faring the best. Health & Safety was the weakest performer with negative contributions coming from both deciles.

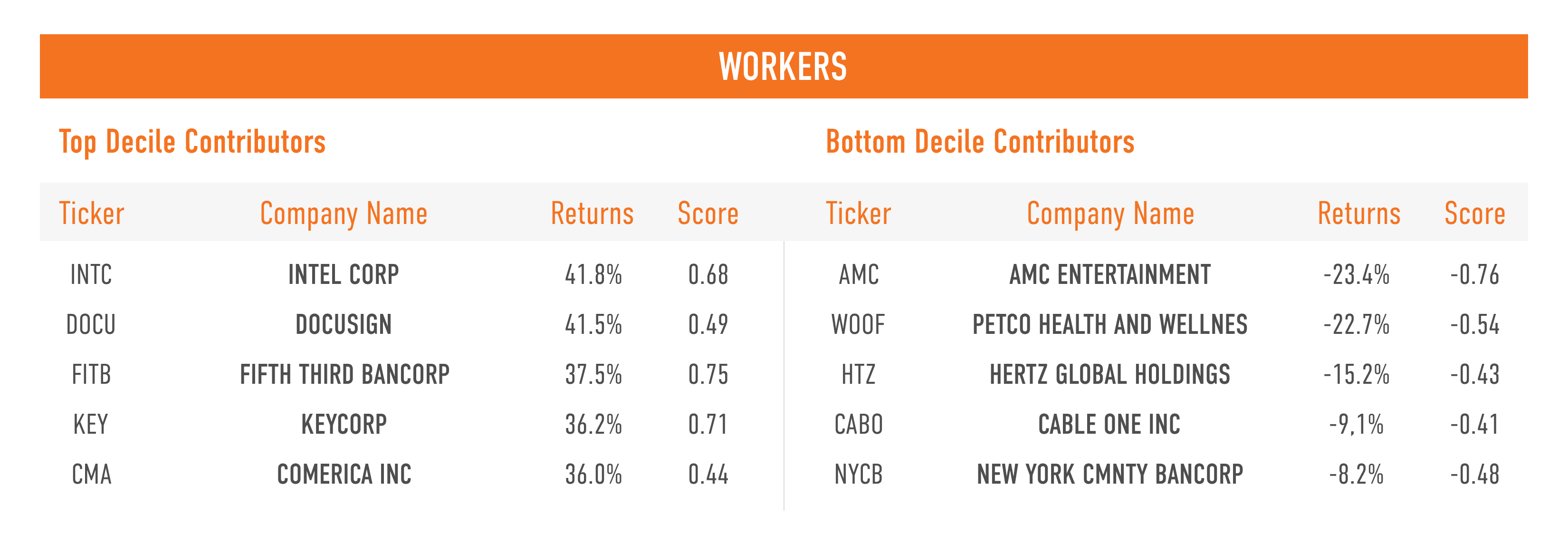

Shown below are the top and bottom five contributors to the top decile (D1), the top-ranked companies as measured by their Workers score, and the bottom decile (D10), the lowest-ranked companies as measured by their Workers score.

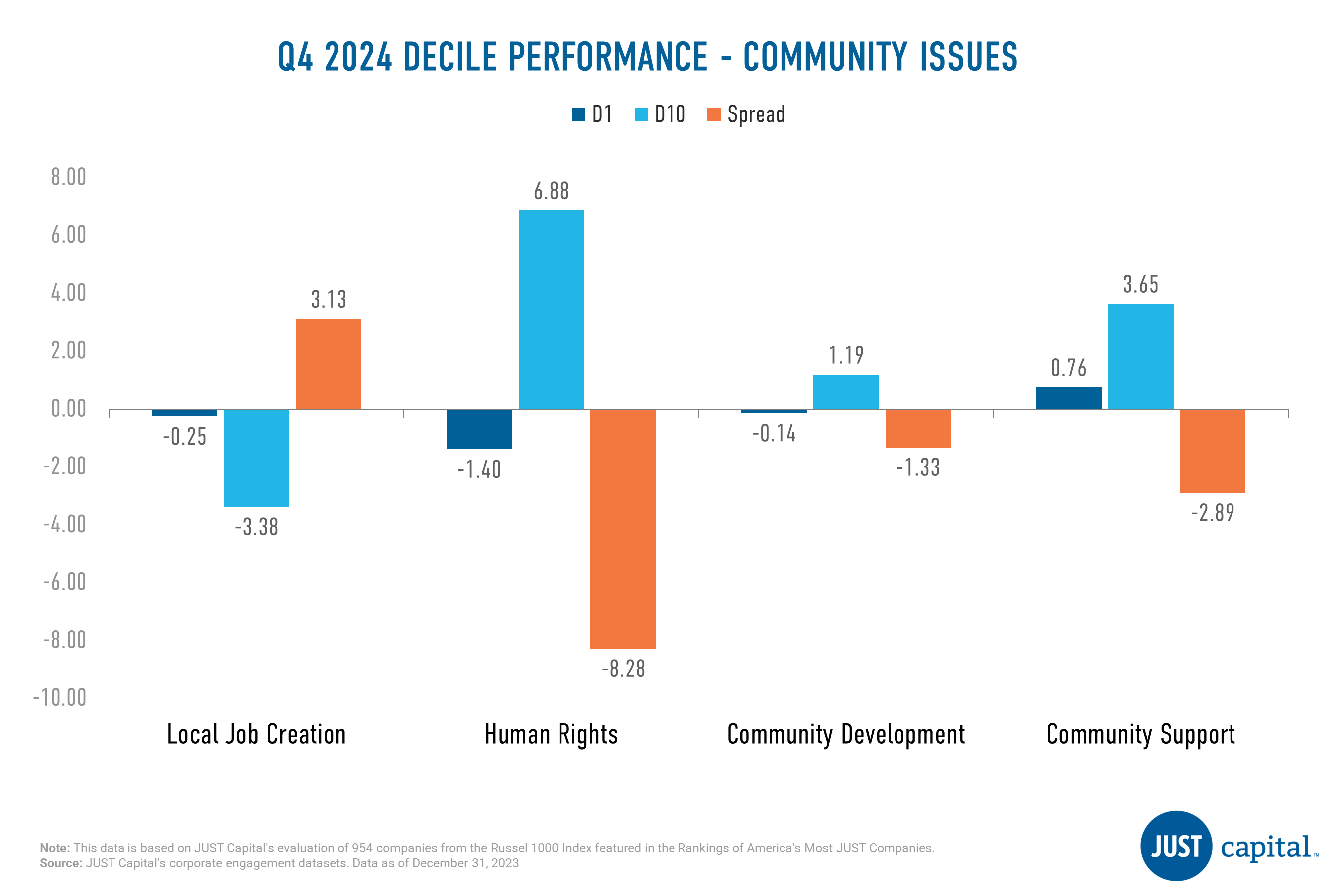

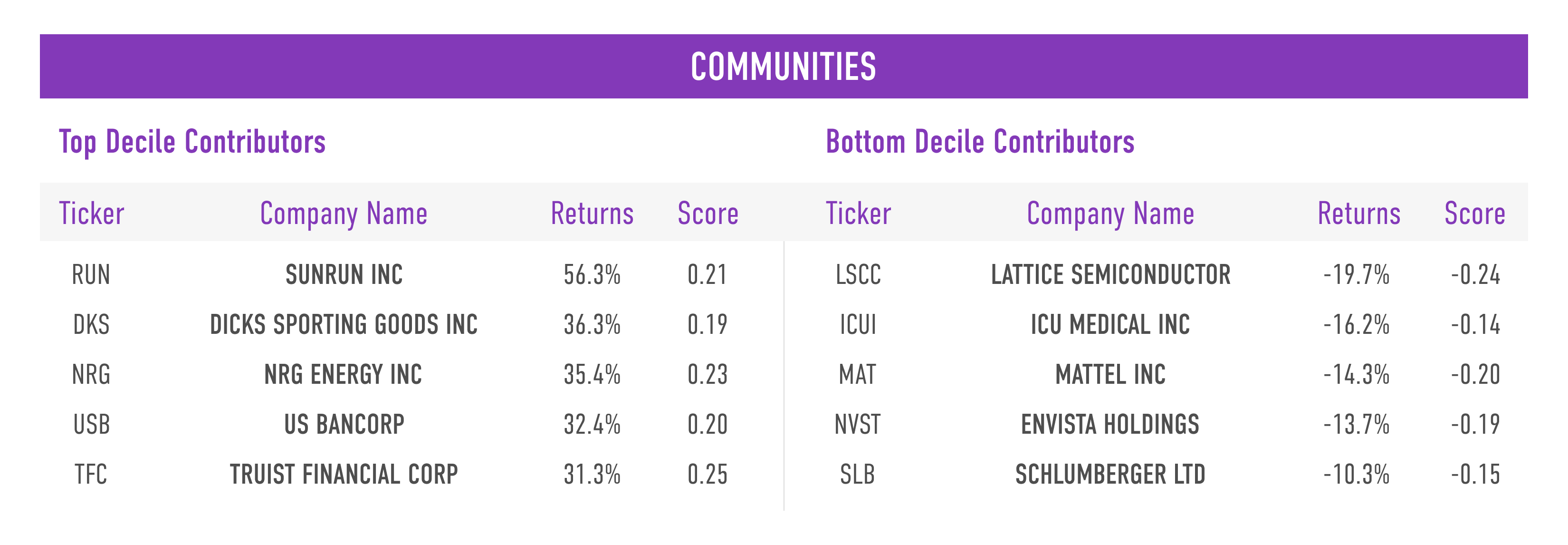

Communities

The Communities stakeholder measures a company across four Issues:

- Local Job Creation

- Human Rights

- Community Development

- Community Support

Human Rights was the weakest performer followed by Community Support. Local Job Creation was the top performer with positive contributions coming from the bottom decile.

Shown below are the top and bottom five contributors to the top decile (D1), the best-ranked companies as measured by their Communities score, and the bottom decile (D10), the lowest-ranked companies as measured by their Communities score.

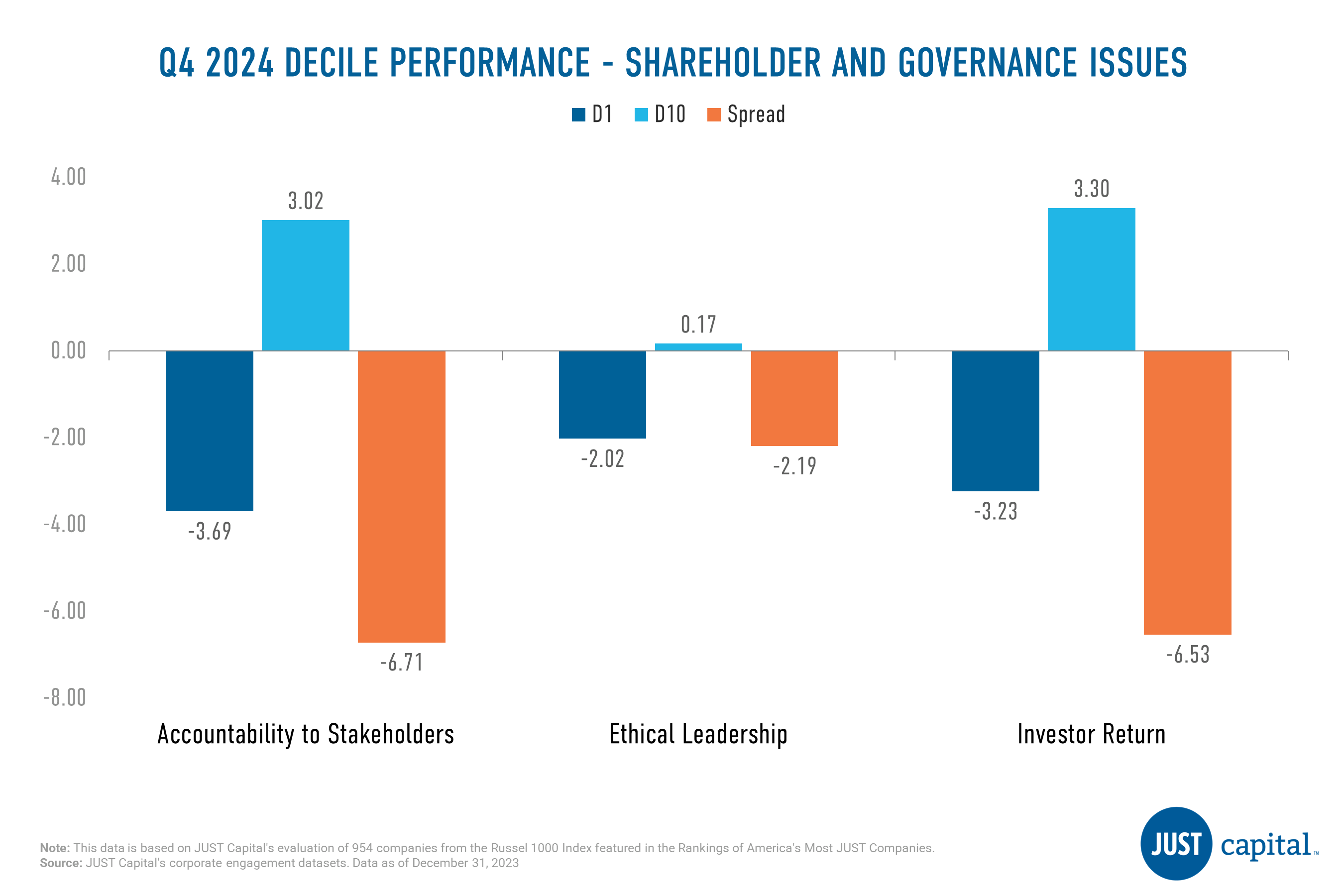

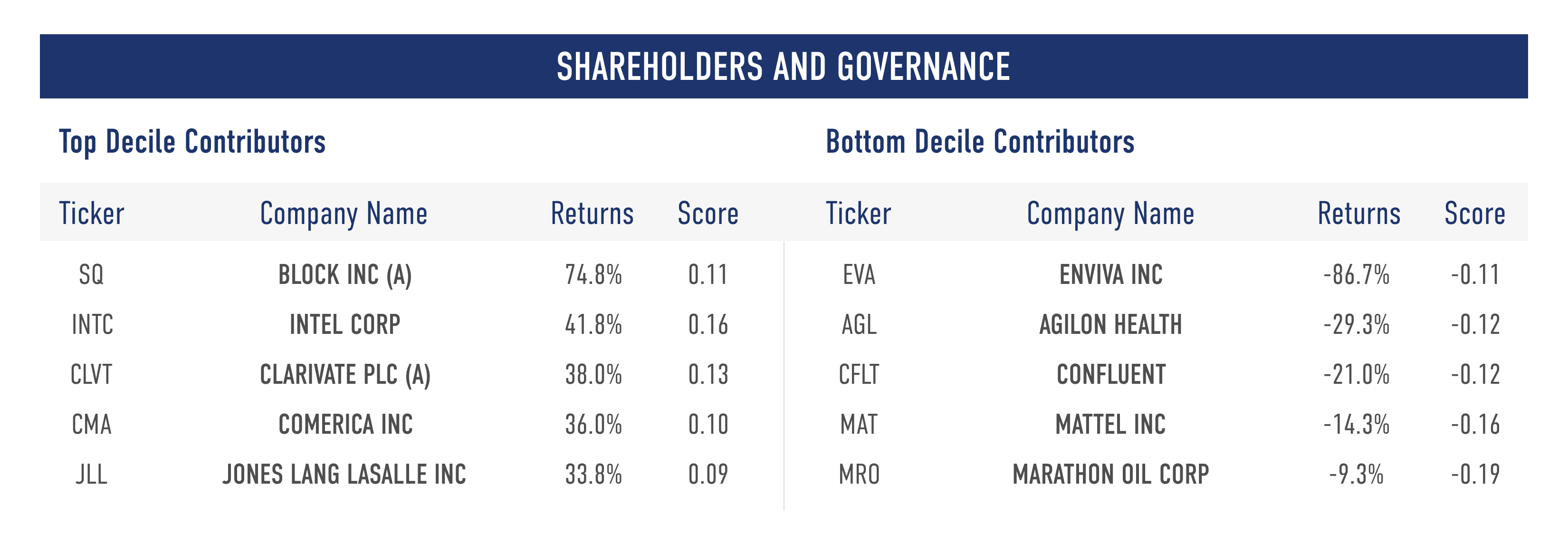

Shareholders and Governance

The Shareholders and Governance stakeholder measures a company across three Issues:

- Accountability to Stakeholders

- Ethical Leadership

- Investor Return

None of the issues within Shareholders and Governance stakeholder delivered positive performance. Accountability to Stakeholders Issue was the weakest performer in Q4 with a long-short spread of -6.71% followed by Investor Return and Ethical Leadership this quarter.

Shown below are the top and bottom five contributors to the top decile (D1), the best-ranked companies as measured by their Shareholders and Governance score, and the bottom decile (D10), the lowest-ranked companies as measured by their Shareholders and Governance score.

Customers

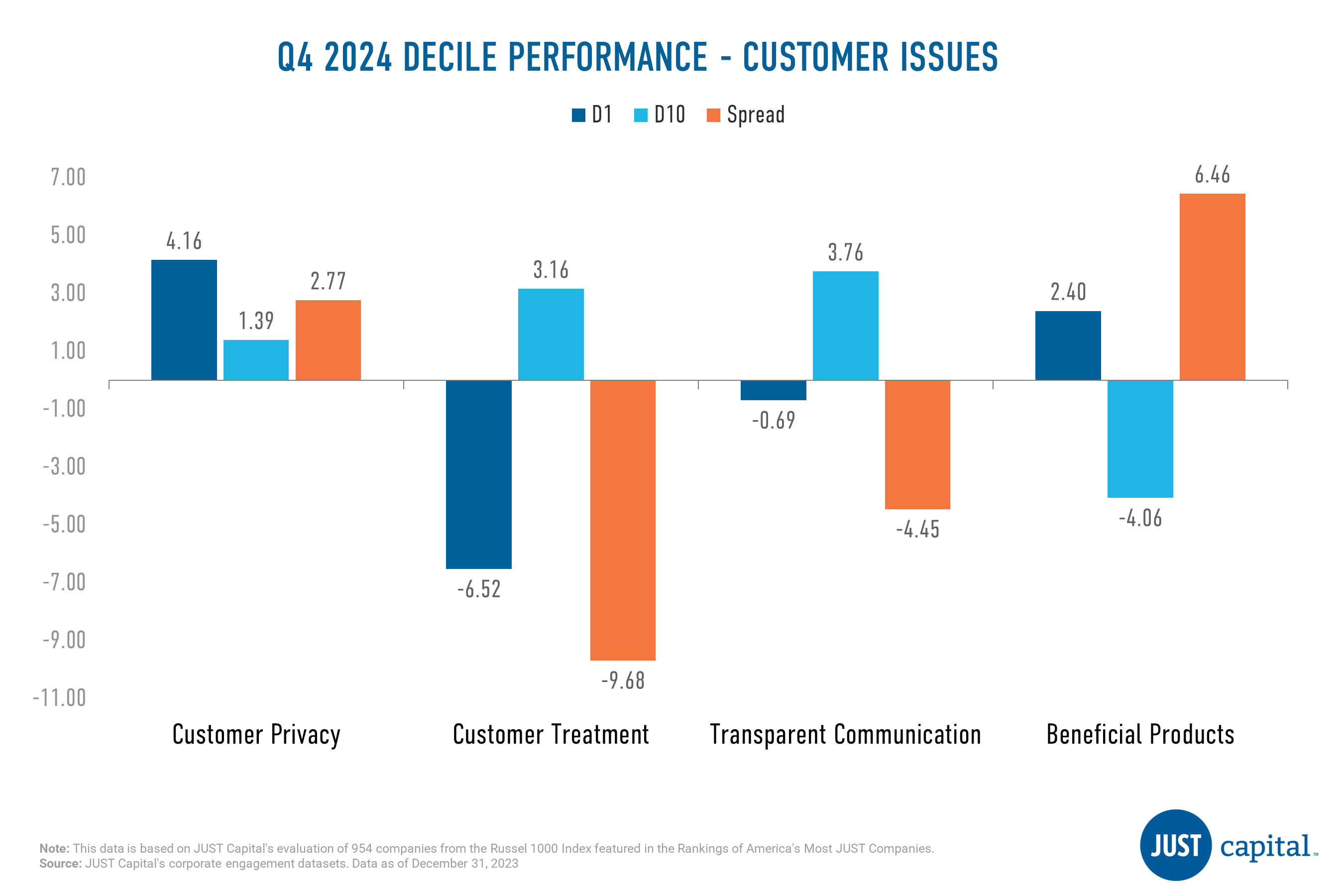

The Customers stakeholder measures a company across four Issues:

- Customer Privacy

- Customer Treatment

- Transparent Communication

- Beneficial Products

In Q4 2023, we saw Beneficial Products outperform the other Customer Issues, with a long-short spread of 6.5%. Customer Privacy also was a positive contributor in Q4. Customer Treatment was the weakest performer followed by Transparent Communication.

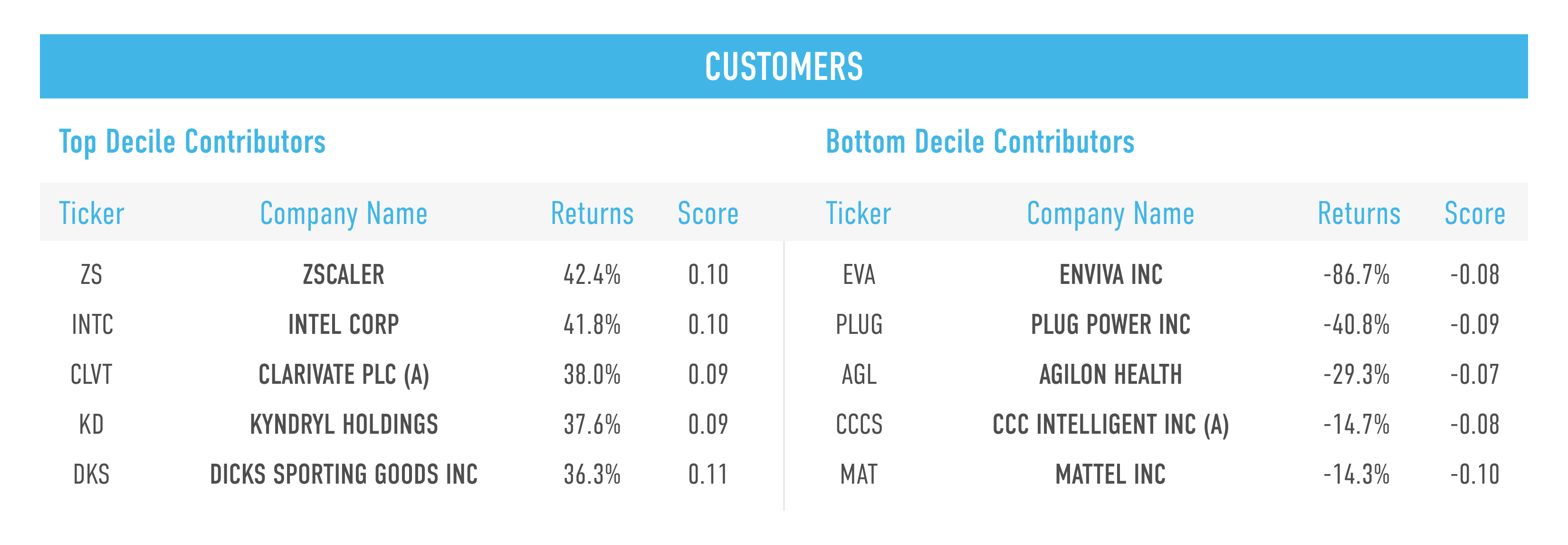

Shown below are the top and bottom five contributors to the top decile (D1), the best-ranked companies as measured by their Customers score, and the bottom decile (D10), the lowest-ranked names as measured by their Customers score.

Environment

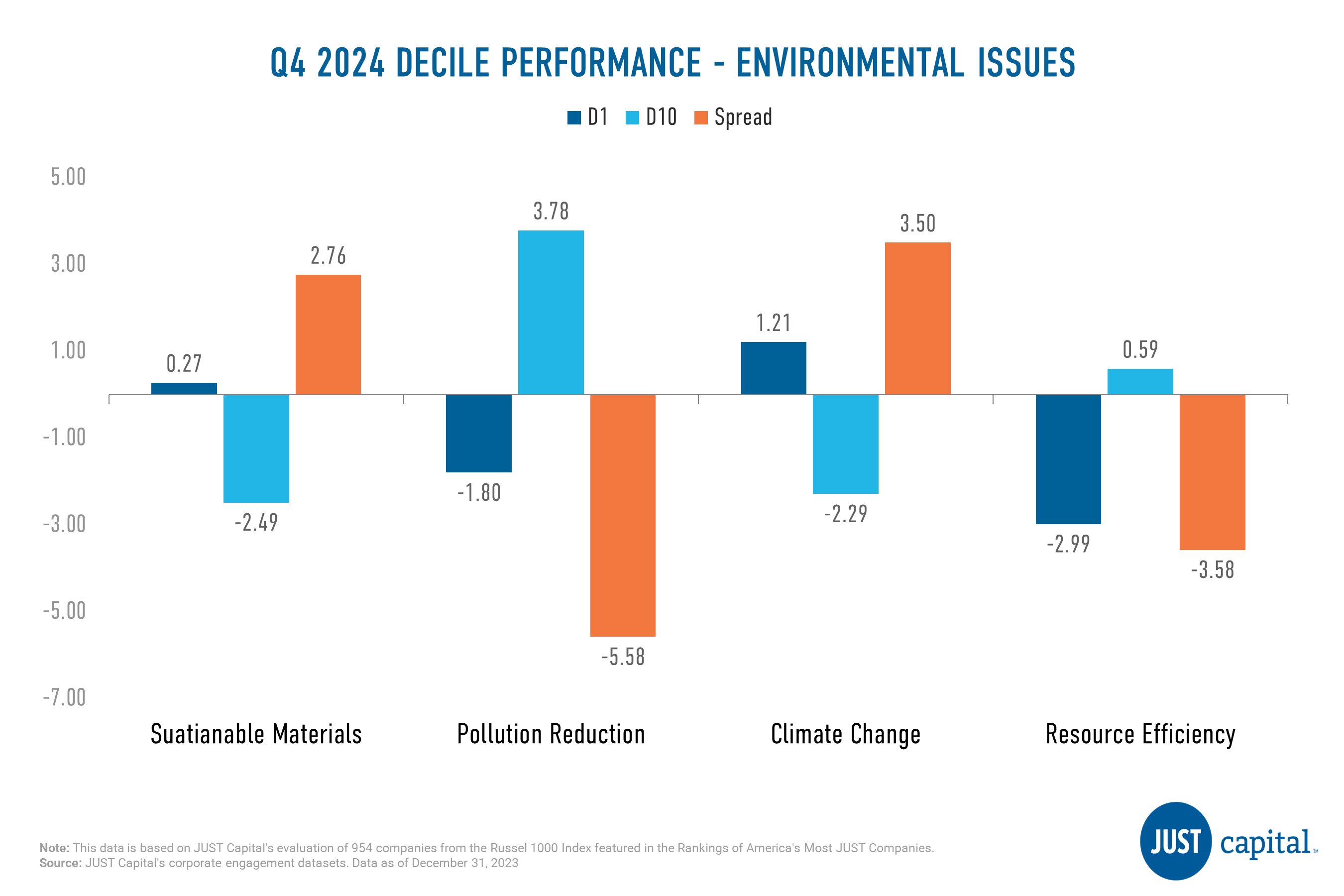

The Environment stakeholder measures a company across four Issues:

- Sustainable Materials

- Pollution Reduction

- Climate Change

- Resource Efficiency

In Q4 2023, we saw two of four Environment Issues deliver positive performance. Climate Change was the top contributor followed by Sustainable Materials in Q4. Pollution Reduction and Resource Efficiency delivered negative performance this quarter.

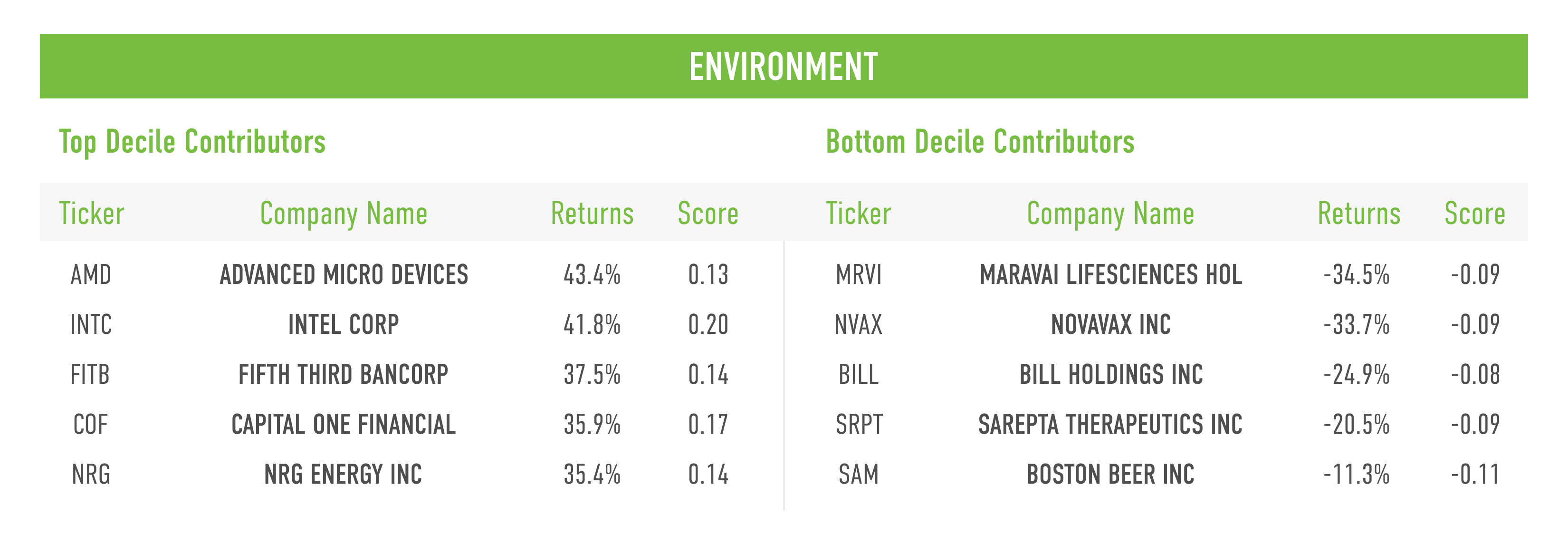

Shown below are the top and bottom five contributors to the top decile (D1), the best-ranked companies as measured by their Environment score, and the bottom decile (D10), the lowest-ranked companies as measured by their Environment score.

Appendix

Computation Methodology

We monitor the performance of these stakeholders and Issues on a long-short basis. The long and short portfolios are selected based on the factor scores as the top and bottom deciles within the universe of companies we track in the Russell 1000. Top decile (D1) companies are those that rank highest based on the factor score, and bottom decile (D10) companies are those that rank lowest based on the factor score.

D1 Performance is computed as (Equally weighted average of returns of stocks in D1 bucket) – (Equally weighted average of returns of all stocks within the Universe)

D10 Performance is computed as (Equally weighted average of returns of stocks in D10 bucket) – (Equally weighted average of returns of all stocks within the Universe)

Spread is computed as (D1 Performance – D10 Performance)