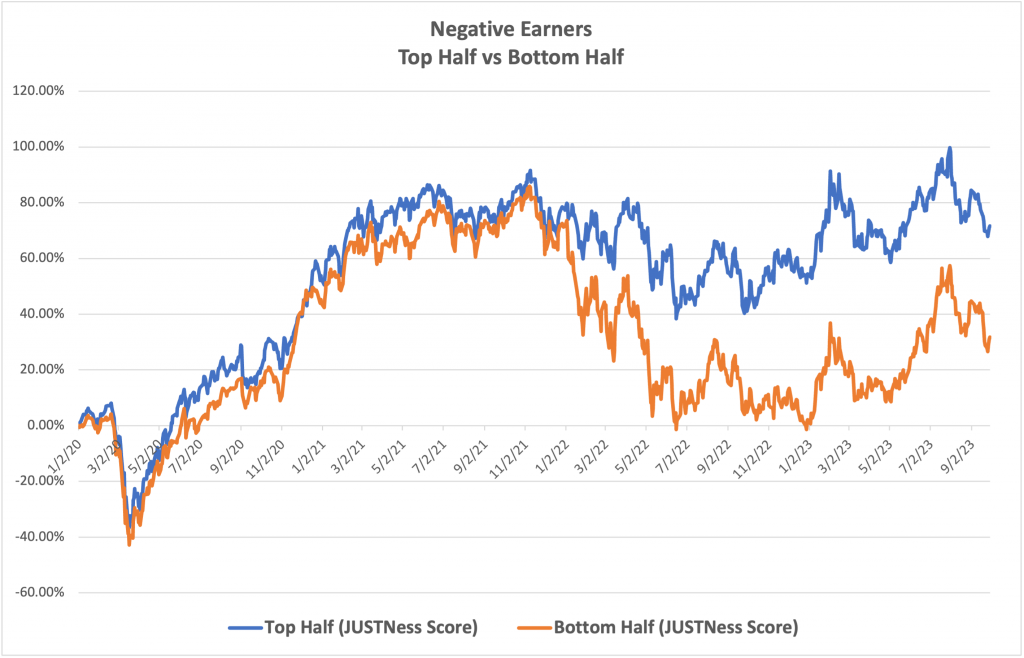

Can JUSTness be used to identify performance leaders within negative earning companies? We think so. In fact, according to our recent analysis, among the negative earners in the Russell 1000 (our coverage universe), JUST leaders have outperformed laggards by almost 40% since January 2020.

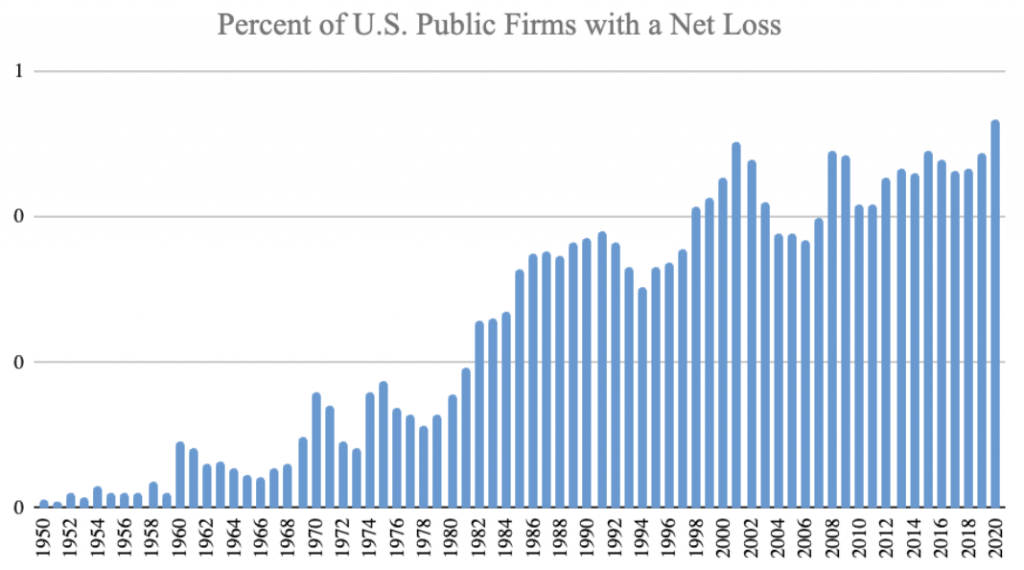

One of the rulemaking petitions from the SEC’s Human Capital Accounting Working group highlighted the fact that in 2020, more than half of U.S public companies reported negative earnings. Many of them are relatively young, technology-heavy firms, where investors are betting on future profitability. Traditional valuation techniques, like PE multiples, are less effective in valuing these firms; rather, investors rely on alternative approaches to form a view, things like investments in management quality, intellectual property and other forms of intangible value. In truth, major value-creating exercises of any modern firm – including research and development, and human capital – appear solely as expenses on the balance sheet – as if they provide no future value.

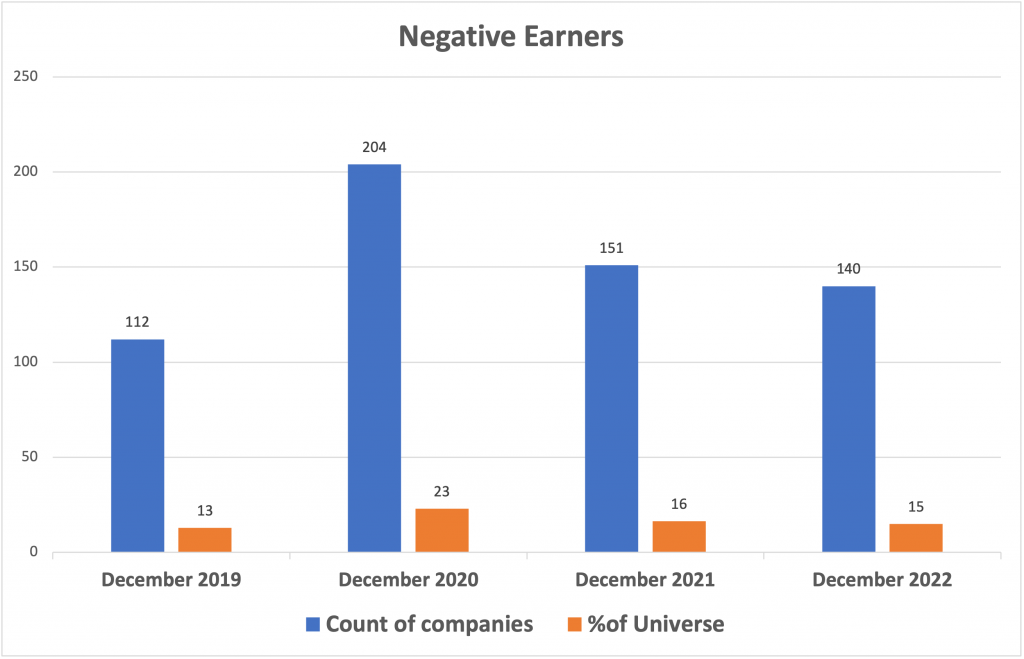

We looked at the number of negative earners within the Russell 1000 every year over a four year period using as a metric Net Income as of year-end, which is when our rankings are typically updated. The total number of companies on the list ranged from a low of 112 in December 2019 (13% of our universe) to 204 (23%) in December 2020.

This overall list was then split into two halves using Overall JUST score as the sole sorting variable, and the aggregate stock market performance of each half determined.

What we found was that the basket of negative-earning companies comprising those ranked in the top half outperformed those in the bottom half by a massive 39.84% between January 2020 and September 2023.

Why might this be? We think the best way to think about it is that negative earning companies with high overall JUST scores can be real diamonds in the rough. Put another way, high JUST scores can signal hidden opportunities. While their financial statements might currently be in the red, their commitment to their workers, to the communities where they operate, to becoming more environmentally sustainable and better governed all stand the companies in good stead for future growth and recovery. Investors can use JUST Overall scores to distinguish between performance leaders and laggards within this challenging segment.

As the investment landscape continues to evolve, integrating stakeholder alignment considerations into decision-making processes becomes not just a choice, but a strategic imperative for savvy investors aiming for sustainable and profitable portfolios.