JUST Report

Here’s What Companies Are Doing to Protect the Financial Security of Their Workers During Coronavirus – and What Good Looks Like in the Long Term

–

This analysis was researched and written by Catalina Caro and Kavya Vaghul.

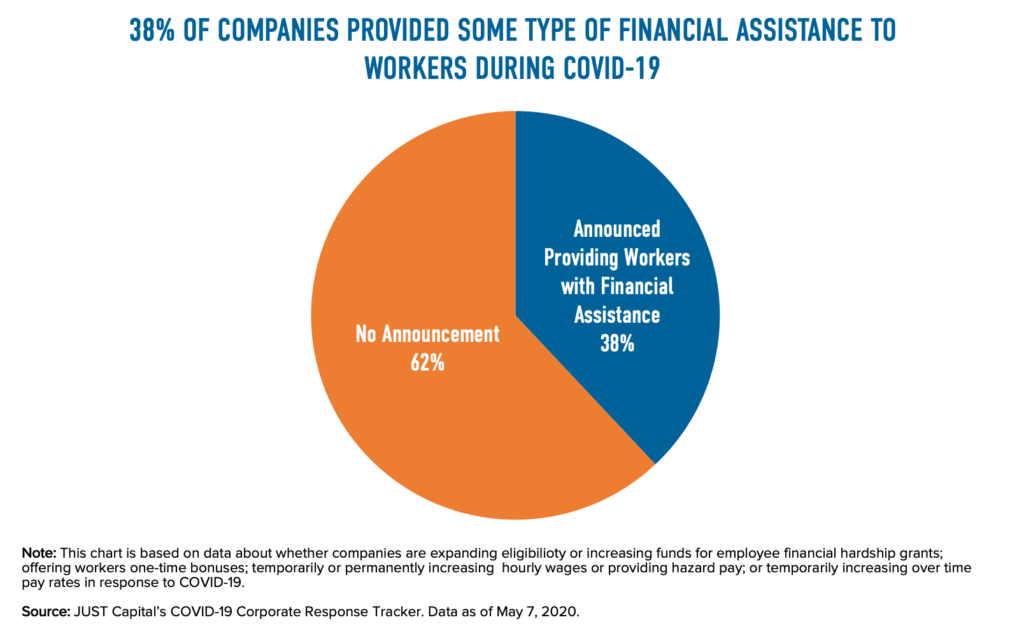

- Of America’s 100 largest public employers, 38 companies have announced that they are providing their workers with some type of financial assistance, double since tracking began in March.

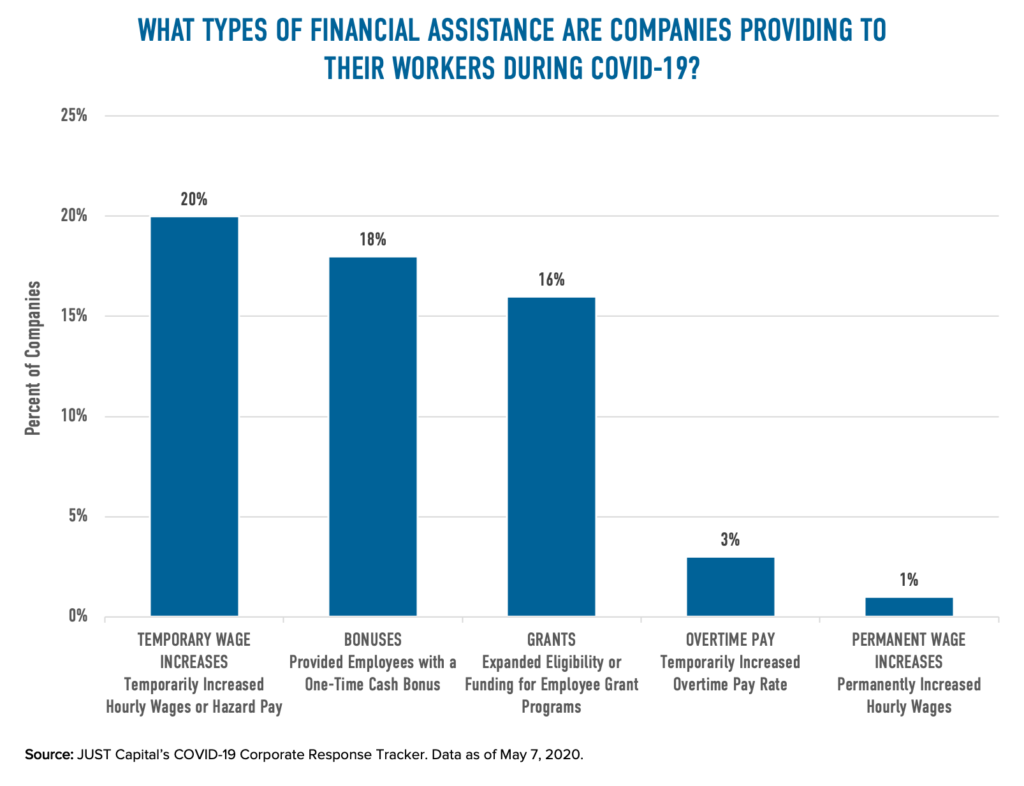

- Eighteen have announced that they are giving employees a one-time cash bonus, and 20 have implemented a temporary hourly wage increase or hazard pay to compensate workers on the frontlines.

- Seven companies – AT&T, Chipotle, Kroger, Lowe’s, Target, Walmart, and XPO– have provided both bonuses and hourly wage increases.

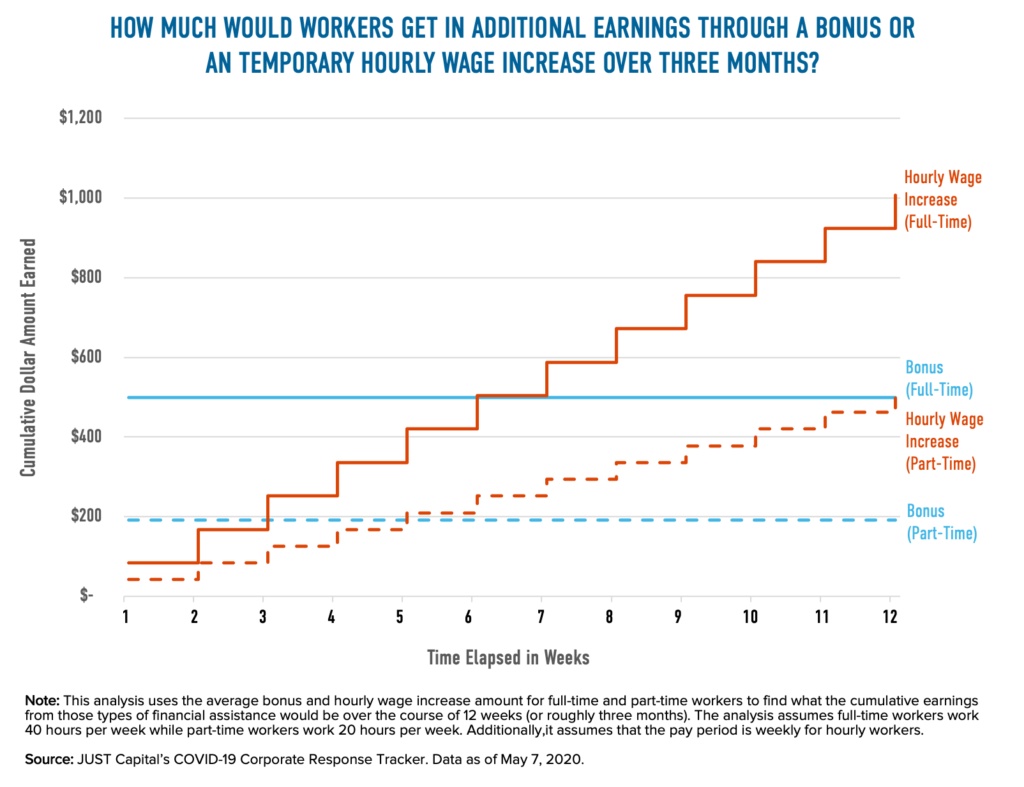

- On average, companies providing wage increases added $2.11 to their employees’ hourly earnings while those providing one-time bonuses offered $500 to full-time workers.

- On average, by the end of six weeks for full-time employees, cumulative earnings from wage increases surpass one-time bonuses.

- Out of the 100 companies we have been tracking, just one – Charter Communications – has announced that it is permanently increasing its hourly workers’ wages.

This piece is part of an ongoing series, where JUST will analyze key dimensions of our COVID-19 Corporate Response Tracker. Though every company is confronting unique challenges, and many are fighting for survival, we have identified the most impactful steps companies can take to financially support their workers, for the duration of the coronavirus crisis and beyond.

Over the past two months, essential workers – including those stocking shelves in grocery stores, driving door to door in delivery trucks, and packing goods in shipping warehouses – have been putting their lives on the line to support Americans during the coronavirus crisis. And yet many of these workers are facing instability, both when it comes to their health and their finances.

According to our annual survey, Americans believe that companies should prioritize pay for their workers first and foremost – with two of the top three issues they identified as essential to just business including paying a fair wage and paying a living wage. And in recent weeks, we’ve polled the public on how they believe companies should respond during the current crisis – and 77% agreed that companies should provide “hazard” or additional pay to employees working in essential jobs.

While Congress has failed to pass legislation to protect the financial stability of essential workers, several companies have stepped up to support their employees on the frontlines. Through our COVID-19 Corporate Response Tracker – which evaluates the actions taken by America’s largest public employers to support their stakeholders during the coronavirus crisis – we have monitored which companies have prioritized financial assistance to their workers.

The actions these companies have taken – from financial hardship programs to one-time bonuses to hazard pay – have been critical in supporting essential workers throughout the crisis. As the pandemic has continued for longer than originally expected, we have seen that some initiatives, like wage increases, provide more significant financial support to workers over time. Charter Communications is the only company that has committed to maintaining wage increases after the crisis – raising hourly employees’ wages to $20/hour, regardless of their starting wage, over the next two years. With mounting inequality prior to coronavirus, and indications that it will widen even further in the aftermath, Charter’s actions demonstrate exceptional, forward-thinking leadership that we hope to see from other companies in the coming months as businesses begin to reopen and more employees return to work.

Below we explore how America’s largest employers are approaching financial assistance, highlight the companies taking the lead, and unpack which efforts make the greatest impact to employees’ financial well-being both during the financial crisis and in the long term.

The COVID-19 Corporate Response Tracker

Here, we explore the financial assistance section of our COVID-19 Corporate Response Tracker, which currently looks at 18 different dimensions of company response to the crisis.

Note that the data in this article reflect our analysis as of May 7, while the tracker is updated regularly.

Overall, our analysis of the 100 largest public U.S. employers shows that 38% of companies have announced providing their workers with some type of financial assistance during the COVID-19 pandemic. Since JUST Capital began tracking disclosure around financial assistance in March, the number of companies that have announced some type of wage support for their workers has doubled.

Types of Financial Assistance Offered During the Pandemic

This financial assistance comes in a variety of different forms.

- 20% provided frontline workers with a temporary hourly wage increase or hazard pay.

- 18% offered their employees, or a subset of them, a one-time cash bonus.

- 16% modified their employee financial hardship and grant programs.

- 3% offered a higher pay rate for overtime work – Amazon, Bank of America, and Home Depot.

- Just one company, Charter Communications, is increasing wages permanently in response to the pandemic.

It’s important to note that not all types of financial assistance are created equal. Hardship grants require employees to actively apply for assistance, and because these programs are needs-based and provide varying amounts of support, there is no guarantee that an employee will be awarded a grant or that the grant amount will be sufficient to help them meet their needs. For these reasons, grants are not a predictable source of wage support amidst the financial volatility experienced by many at this time.

Higher pay rates for overtime work come with some drawbacks, too. For non-exempt employees – those who are eligible for overtime pay – overtime work theoretically provides an opportunity to supplement usual earnings with more pay for more hours worked. But given the heightened health risks associated with long hours of frontline work during COVID-19, employees are implicitly asked to make a tradeoff between supplementing their earnings or staying healthy. What’s more, there is no guarantee that workers will be given additional hours of work.

One-time bonuses and hourly wage increases do not come with the same unpredictability or trade-offs that accompany grants or higher overtime pay rates, but reward employees equitably for providing essential services during the pandemic.

Bonuses vs. Hourly Wage Increases

The natural next question is which – bonuses or hourly wage increases – should companies prioritize? To answer this, it is critical to understand just how much employees stand to make under each policy.

The amount given in bonuses varies significantly between companies. The lowest bonuses are $150, while at the other end of the spectrum (usually reserved for employees in management roles), payments go as high as $3,700. On average, however, companies offered full-time workers $500 and part-time workers $192 in one-time bonuses. When it comes to hourly wage increases, the average company added $2.11 to employees’ hourly earnings.

At face value, bonuses appear to give a substantial amount of money to employees up front, which can help immediately curb the impact of emergency health-related expenses, among other financial burdens, during this time. Over the long run, however, the cumulative earnings from a bump in hourly wages surpass the amount transfered through a one-time bonus.

In looking at the impacts of the typical bonus and wage increase over 12 weeks, we see that average wage raises for part-time and full-time employees surpass their average bonus amounts within five and six weeks, respectively.

Considering the long-term health and financial repercussions of COVID-19, the scenario in the figure above demonstrates that companies that are financially able to do so should consider offering their essential workers an hourly wage increase over a one-time bonus. It also drives home the long-term impact of Charter’s decision to permanently raise wages to $20 per hour for hourly employees, a move that will support workers throughout the crisis and beyond.

What does “good” look like?

Companies across different sectors face unique challenges, and many have had to weigh difficult decisions in assuring the future of their business. Those with considerable frontline workforces have needed to act quickly to ensure that their employees are well-positioned to stay at work – and through initiatives like expanding paid sick leave, along with prioritizing financial assistance, some companies have shown great leadership even in the face of profound uncertainty.

As we’ve shown above, those that provide wage increases offer greater long-term security to frontline workers, but the immediate benefit of one-time bonuses must also be recognized. Seven companies have provided both hourly wage increases and bonuses to their workforces: AT&T, Chiotle, Kroger, Lowe’s, Target, Walmart, and XPO, all of which have a considerable number of essential workers who are continuing to serve on the front lines. In fact, Lowe’s just provided a second bonus to workers this week, as its temporary wage increase period comes to a close. In providing both, these companies have given their workers both a preliminary boost to ride out the initial challenges of the crisis, as well as consistent support over time as they continue to work.

These efforts must be applauded, but as companies begin to reopen and we look ahead to what our post-COVID economy will look like, we also must remember that economic inequality existed long before coronavirus, and many of the workers on the front lines today are also those who will struggle with financial instability in the aftermath. For example, Amazon announced that workers who can work from home, usually those earning higher wages, can continue to safely do so until October, while financial assistance for frontline workers is currently expected to expire on May 16.

Companies looking to protect their workers from the long-term impacts of pandemic and economic recession should consider, like Charter, committing to a permanent wage increase, not only boosting wages in the immediate future, but guaranteeing higher wages – and perhaps encouraging stronger motivation from workers – in the months and years to come. In its April 2 announcement, Charter explained that a key reason behind its decision is its employees’ hard work to maintain network operations throughout the crisis. Acknowledging that employees are its greatest resource, Charter has committed to both rewarding and protecting the workers that will keep business running, both during the pandemic and for years to come. With an overwhelming majority of Americans looking to companies to pay a fair and living wage to all their workers, more companies should consider following in Charter’s footsteps – implementing practices that protect their workers today and support them ongoing, whatever the future may hold.