Our COVID-19 Corporate Response Tracker Can Be a Resource for Showcasing Your Commitment to Stakeholders This Earnings Season

Investors are taking note of stakeholder priorities. (Adobe Stock)

As the earnings season continues amid global health and economic crises, we wanted to recommend using JUST Capital’s COVID-19 Corporate Response Tracker as a tool to help assist your company with showcasing your stakeholder leadership.

COVID-19 continues to impact the lives and livelihoods of your workers, customers, and the communities that you operate in, and investors are increasingly seeking insights into how companies are responding to their stakeholders. Since the beginning of the COVID-19 outbreak in the United States, JUST has been tracking policy disclosures, best practice insights, and data trends regarding how our companies are supporting their stakeholders through the crisis. We believe that by increasing transparency on key issues related to the pandemic, companies can demonstrate to investors their commitment to stakeholder and ESG leadership.

ESG factors, specifically around human capital management, have taken center stage during the time of COVID. In the past month, 286 institutional investors representing $8.2 trillion have signed an investor statement calling for companies to provide paid sick leave, prioritize health and safety measures, retain their workforce, maintain supplier/customer relationships and to remain financially prudent in response to coronavirus.

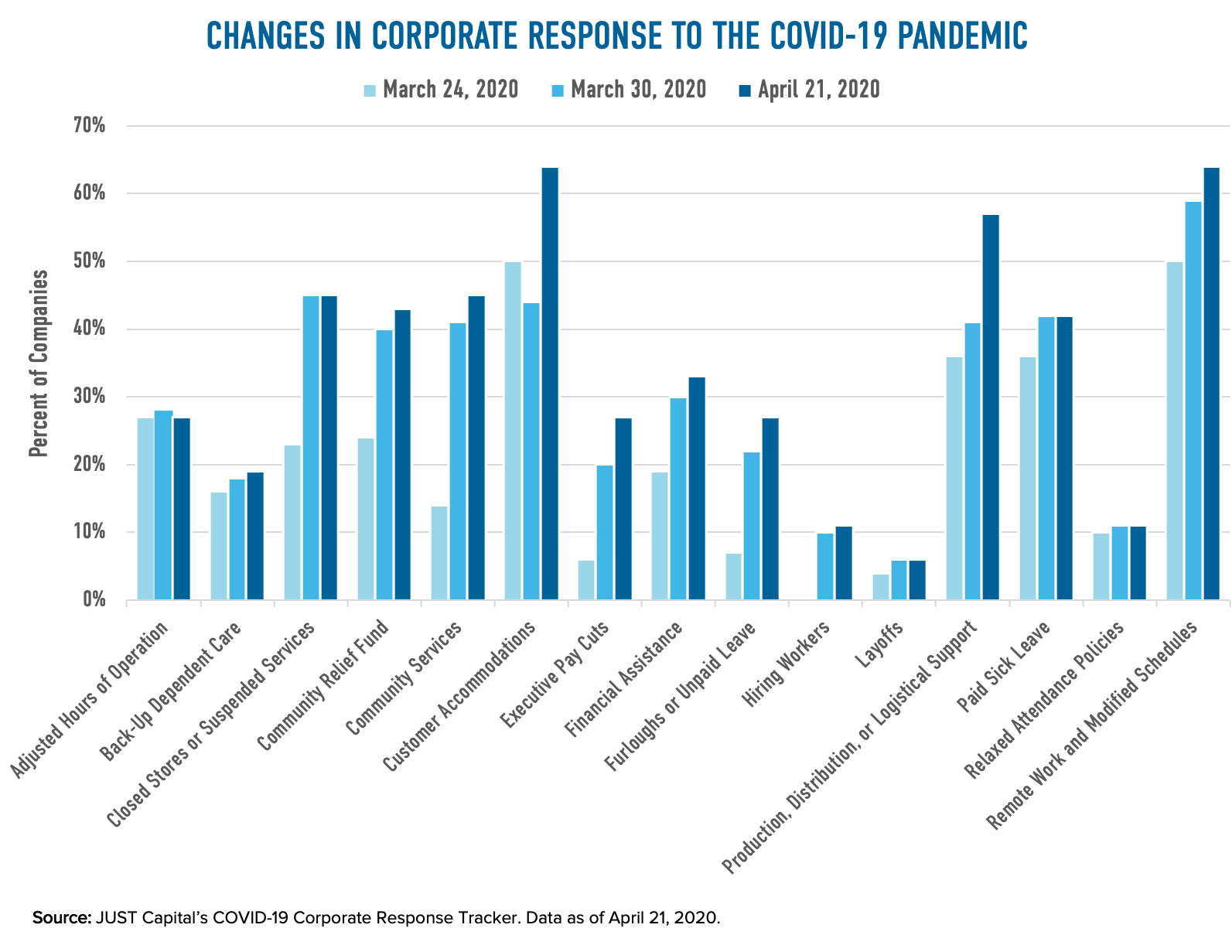

Through our COVID-19 Corporate Response Tracker, we have been assessing what America’s 100 largest public employers are doing in response to the pandemic across 19 separate dimensions – from the number of paid sick leave days companies offer, to the amount of bonus and hazard pay, to dollars contributed to community relief funds, and the number of employees furloughed. Investors have been using our tracker as a resource to understand how companies are approaching challenges faced by internal and external forces and how they have remained committed to their stakeholders.

We have been tracking the largest 100 employers in the US. (JUST Capital)

Our research shows that stakeholder-focused companies that prioritize their workforce outperformed their peers by 7.3% in Q1 2020. Reports from Morningstar, and others, have found that ESG investments have proven to be a clear form of risk mitigation, and alpha generation in this downturn, and investors are clamoring for meaningful, transparent, insights into ESG factors.

Investors are taking notice. We’ve seen net inflows of $2.7 billion dollars pour into ESG equity funds in Q1 2020 and $5.7 billion in net outflows hit the broader equity mutual fund category. The way companies respond to COVID-19 provides tangible metrics on materiality that have never been more applicable. We surface all of these metrics within our tracker, offering transparent insights and best practices that can be utilized by your IR teams to engage with investors during earnings season.

We understand that transparency is only one piece of the puzzle in this rapidly changing environment, but as investors increasingly look to ESG metrics for information on where the company is today, and how the company’s response to COVID-19 is changing, we believe it’s more important than ever to disclose this information.

For more information about our Corporate Response Tracker, or our ESG insights, please contact our corporate engagement team.