3 Charts That Show Why Companies Should Regularly Raise Wages to Match Inflation

JUST Capital’s polling of the American public and current policy debates continue to emphasize the importance of inflation and worker wages. We recently featured new data analysis showing low disclosure among the Russell 1000 companies on minimum wage rates and public minimum wage increase announcements resulting in real wage gains, and we also wrote a Fortune editorial dispelling the wage-price spiral myth and making the case that companies can unlock business value by regularly raising employee wages to match inflation.

This week, the Bureau of Labor Statistics reported that the headline CPI in November increased 7.1% year over year, and the core CPI – excluding food and energy – increased 6%. These were both lower than the figures for October and suggest that inflation is cooling, though price pressures remain throughout the economy. In turn, the Federal Reserve slowed the rate of increase in the federal funds rate to 0.5%, down from 0.75% in previous meetings.

Another highlight from this week is that even though real wages grew from October to November, they still declined year over year – they fell 1.9%, on average, despite nominal wage growth. However, some in the media continue to imply that workers’ nominal wage increases are the main driver of inflation and need to be reduced to lower inflation. This is despite empirical research from the International Monetary Fund showing that nominal wages can continue to increase while inflation declines, allowing real wages to eventually grow, and Federal Reserve Bank of San Francisco President Mary Daly saying last month there is no evidence of a wage-price spiral. In addition, household debt has reached multi-year highs, and the personal savings rate has dropped precipitously to its lowest since 2005.

Only time will tell if the Federal Reserve is able to achieve a “soft landing” or if it will push the economy into a recession. It is worth emphasizing, however, that even though inflation will likely decline further in 2023, it will remain above the Fed’s 2% target, which will continue to negatively impact family budgets if real wages continue to decline.

Within this context, to help investors, companies, and workers understand the relationship between inflation and wages, we are presenting three charts to concisely show how inflation reduces the purchasing power of wages and causes pay cuts for workers over time.

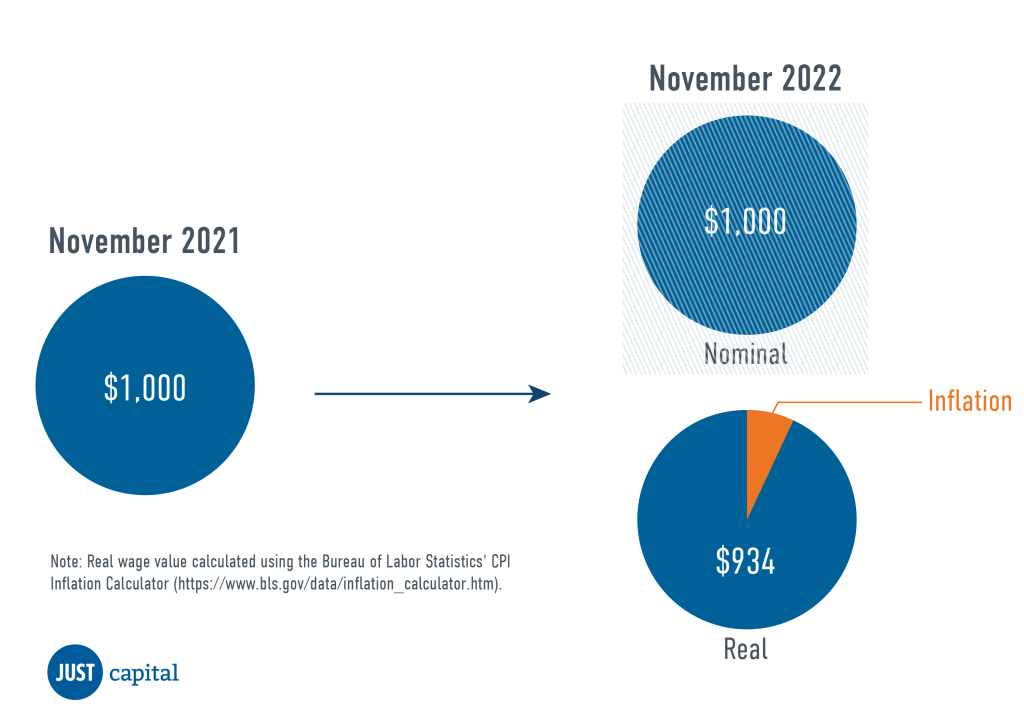

1. Inflation Reduces Purchasing Power

Imagine the following scenario. You have $1,000 in cash in November 2021. You don’t spend it, so you still have $1,000 in cash in November 2022. But because annual inflation was 7.1%, that money is really worth $934 in November 2021 dollars. $1,000 is the nominal value, and $934 is the real, and the real value is what matters for workers and companies.

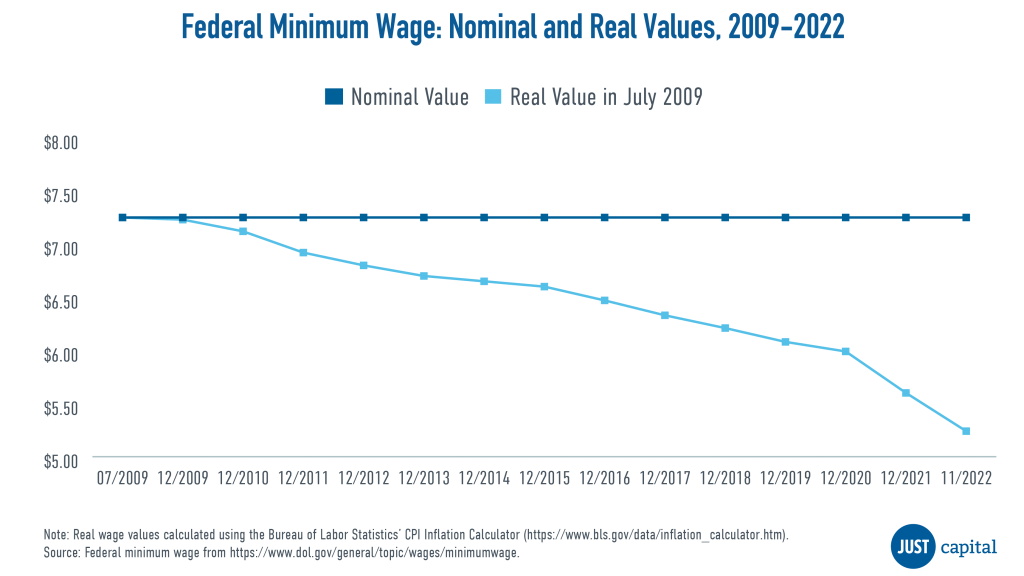

2. Without Wage Increases, Inflation Causes Pay Cuts for Workers

We can see how inflation affects wages by looking at nominal and real values over time. When wages are not increased, their real value, or purchasing power, declines. Because the federal minimum wage has not been raised since July 2009, when it was set at $7.25 per hour, its real value has dropped, and in November 2022 it had a purchasing power of $5.24 in July 2009 dollars. This means that a worker earning the federal minimum wage has effectively received a 28% pay cut over the past 13 years due to inflation.

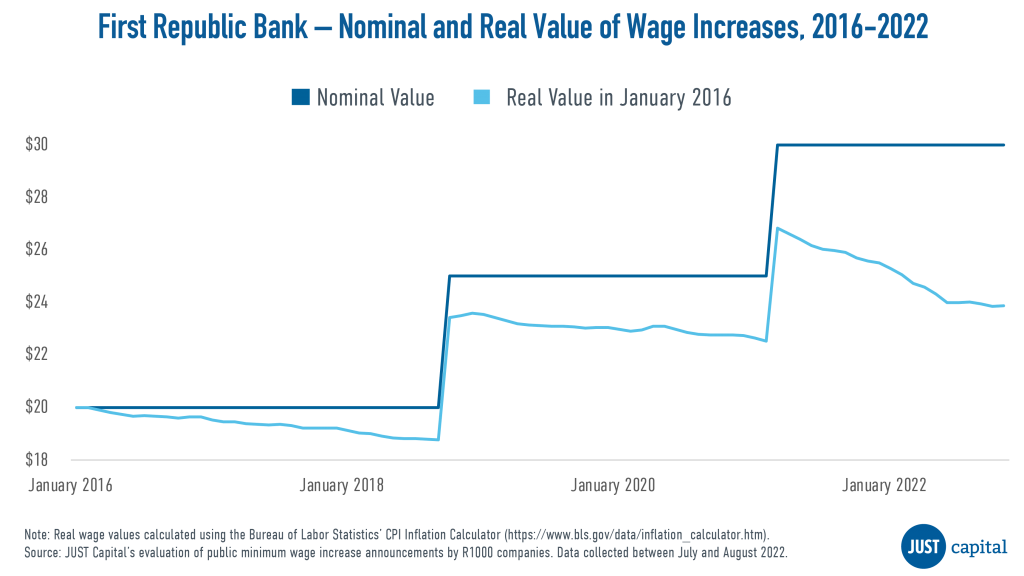

3. Even With Wage Increases, Inflation Causes Pay Cuts for Workers in the Period Between Each Increase

Even when wages are adjusted upwards by wage increases, inflation causes the real value of wages to decline in the periods between wage increases. First Republic Bank offers the highest publicly announced minimum wage rate among the R1000 companies at $30 per hour, and it has granted three wage increases since January 2016. But as can be seen, inflation causes a pay cut for workers in the periods between each increase, and the real value of wages is one of peaks and valleys due to inflation. In addition, that pay cut is amplified when the inflation rate is higher (i.e., compare the steepness of the curve from March 2021 to November 2022 compared to the previous two periods between wage increases when inflation was lower).

These charts show how inflation reduces the real value of wages over time. This hurts American workers, who effectively receive pay cuts, as well as American companies, which potentially face lower employee satisfaction, retention, and productivity. Regardless of how successful the Federal Reserve will be in achieving a “soft landing” in 2023, businesses can unlock value by understanding this relationship between inflation and wages and regularly raising employee wages to match inflation, benefitting workers, companies, and the U.S. economy at large.