The U.S. fixed income (bond) market rivals the U.S. equity market in valuation, with total issuance of $49.1 trillion, and $10 trillion, or 20% of that is corporate debt. In this piece, we’ll investigate the corporate debt market, looking both at how opportunities in debt compare to those in equities in this moment, and how companies that prioritize all their stakeholders as represented in the JUST Rankings enjoy better credit ratings.

After the 2008 global financial crisis, the Fed and other central banks engaged in unprecedented quantitative easing, suppressing global interest rates. While low interest rates supported equity and other asset (including bond) prices, they were a challenge for retirees and other savers needing current income. More recently, renewed inflation accompanying the emergence from the economic disruptions of COVID forced the Fed to increase rates in response, leading to declines across both stocks and bonds in 2022.

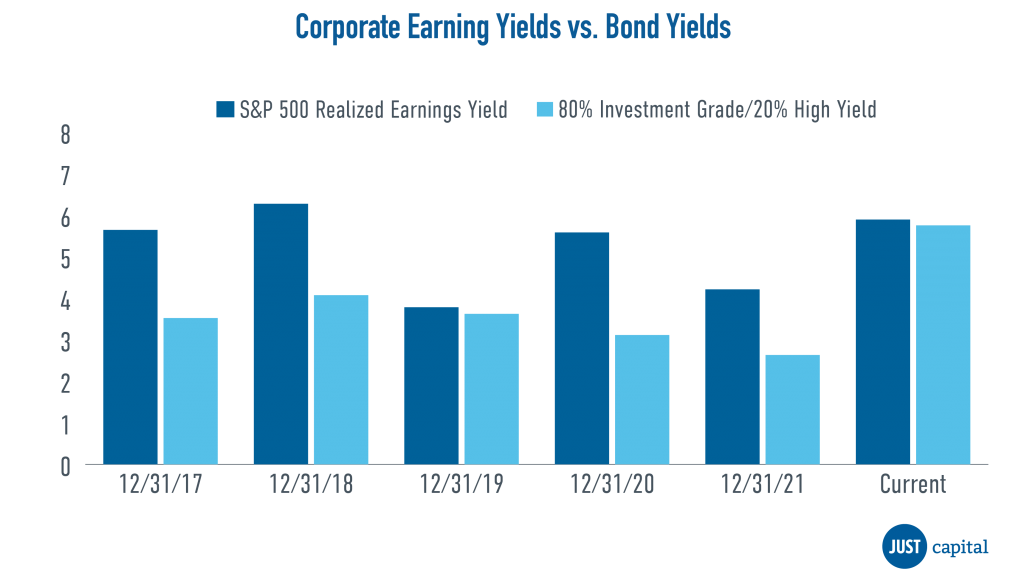

As investors consider what’s next for interest rates, economic growth, and prospective returns from different asset classes, the natural, evergreen question of “Where should I invest now?” is front of mind. One broad comparison worth looking at is the expected earnings yield on equities versus the available yield on bonds. At a macroeconomic level, investors choose between earning the yield from bonds in coupon payments, or the income yield from stocks. In the chart below, the corporate earnings yields are the actual realized earnings for S&P 500 companies in that year divided by the S&P 500 index value at the prior year’s end. The value for 2023 is based on consensus 2023 earnings estimates.

We generally see the S&P 500 earnings yield handily outperforming the available yield from corporate bonds over this period. The exception, of course, came in 2020 when earnings collapsed during COVID. However, a portfolio of corporate investment grade and high yield bonds now offers an attractive prospective yield compared to equities, suggesting that the time to invest in corporate debt may be upon us. While the asset price adjustment of 2022 was painful for both equity and debt holders, an era of more normal interest rate policy in a pro-inflationary economy will offer opportunities for investors to diversify risk across the economic cycle.

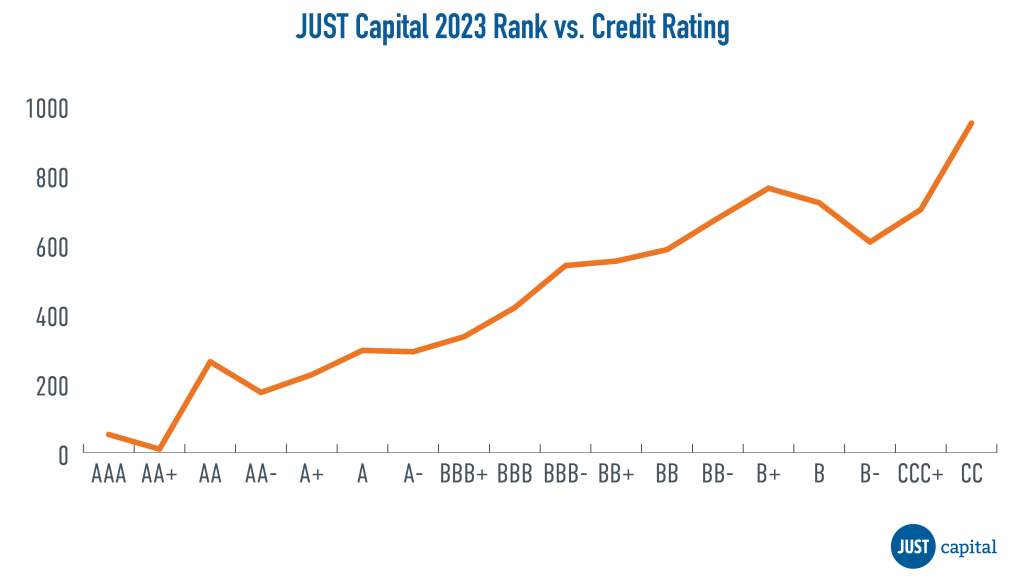

JUST Capital tracks companies in the Russell 1000, and we’ve observed a strong relationship between a company’s placement in our Annual Rankings of America’s Most JUST Companies and its long-term credit rating. Companies that succeed in prioritizing their workers, customers, communities, shareholders, and the environment – as reflected in the JUST Rankings – also enjoy the advantage of better credit ratings and lower borrowing costs.

The chart below shows the mean JUST 2023 rank within each S&P long-term credit rating category at December 31, 2022. (Of the Russell 1000, 27 ranked companies with a “Not Rated” credit designation and 251 ranked companies with no credit designation were excluded. The “spikes” on the edges of the chart, at ratings AA and CC, are due to the small numbers of companies in those categories.)

This correlation should not be surprising. Although credit ratings focus on financial measures of strength and JUST Rankings are based largely on non-financial measures of corporate stakeholder performance, they both distinguish companies on management quality and how they manage the balance of risks and opportunities.

Building on this finding, we’ll be further exploring the debt markets and the relationship between JUST Rankings and corporate bonds further throughout this year.