Significant Correlation between JUST Companies and Lower Market Risk, According to Newly-Released Analysis

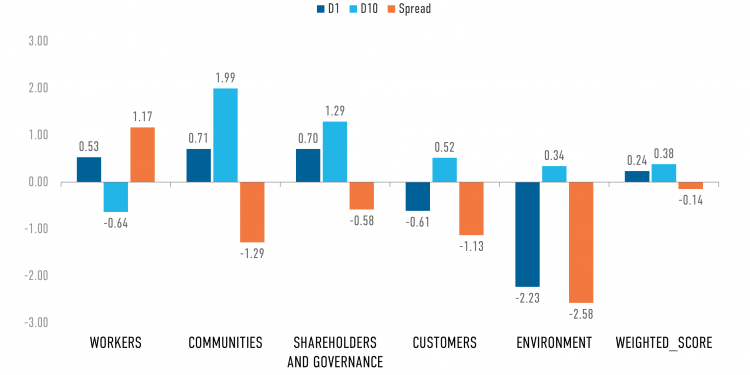

According to new research by JUST Capital, companies in the Russell 1000 that perform better on issues that matter to the American public carry significantly lower investment risk than other Russell 1000 corporations. The top performing companies on public priorities, overall, came in at 24.5% in three-year stock volatility, compared to the other companies at 27.8%, suggesting that “just” companies are less volatile on the stock market. The JUST score was established by JUST Capital and Forbes Magazine in 2016 to rank companies on issues that matter to the American public, a process that establishes what the public values, and then ranks companies on those issues. The 100 top performing companies in their industries were designated the JUST 100.

Through analysis of stock volatility and profit variation metrics, JUST Capital analysts determined that companies who behave more justly are also more stable financially. The analysis found statistically significant evidence that stocks in the top quintile of JUST scores have superior risk attributes compared with those in the bottom quintile. At AT&T, for example, the three-year stock volatility, or the degree of variation in the stock price, is 14.8%, as compared with other non-JUST 100 corporations at 27.8%.

“This research provides a better understanding of the relative resilience of stocks of companies who are acting responsibly and justly, valuable information for both asset owners and asset managers,” said Paul Tudor Jones, founder and chair of JUST Capital.

“JUST Capital exists to give voice to the American people on the things they want publicly-traded companies to prioritize. This research indicates that what people identify as important also is a good screen to understand which companies are better performers in the market,” said Martin Whittaker, CEO of JUST Capital.

The analysis also shows that comparisons in earnings-per-share (EPS), which capture shifts in profits over the past three years, varies significantly among the top quintile of JUST ranked companies to their industry peers. Top quintile companies average 33.3% while the remainder of the Russell 1000 are at 47.6%. At Microsoft, one of the companies with the highest JUST scores, the EPS variation is just 11.6%.

The research also shows that more JUST companies have a higher return on invested capital, suggesting that more just practices correlate with a better payoff for stockholders. JUST 100 companies average 13.6% ROIC, while non-JUST companies average 9.9%. Colgate-Palmolive stands out with 27.1% return for shareholders.

For more information, please contact:

Michelle Mullineaux

Director of Marketing

Email: mmullineaux@justcapital.com

Phone: (646) 854.2156