JUST Report

The JUST Capital Rankings on Corporate Tax Reform

- More Reports

- View all JUST Reports

In 2018, the Russell 1000 companies we track and analyze for our rankings are set to receive a tax windfall of nearly $150 billion. How will companies distribute this money? Who will benefit most? Will corporations pass savings onto workers? Invest in growth? Give back to their communities? Reward management and shareholders?

At JUST Capital, we are dedicated to elevating the voice of the American public to track corporate behavior and build a more just economy. Since 2014, we’ve conducted some of the most exhaustive polling ever done (engaging 72,000 people to date) to identify what issues are most important to Americans when it comes to just business behavior. Worker pay and treatment have topped the list each and every year.

This tax cut presents companies with an ideal opportunity to begin allocating resources in ways that better align with the public’s priorities.

Our analysis shows that, of the 145 companies that have so far announced their intentions, six percent of tax cut-related savings are being allocated to workers, more than half of which takes the form of one-time bonuses, as opposed to permanent raises or benefits. An additional 18 percent is allocated to job creation. And if we assume that all proceeds not already earmarked for other uses actually flow to management and shareholders in the form of stock buybacks or direct distributions, then 56 percent of corporate spending will go back to investors. To improve comparability, all investments are before any applicable tax deductions.

JUST Capital shines a light on how companies perform on the issues Americans care about most. So in addition to tracking where the tax windfall is going overall, we created The Rankings on Corporate Tax Reform to help clarify how each tax announcement is being invested, and how those investments score against the priorities of the American people, which include better pay, bonuses, benefits, as well as job creation, beneficial products and customer experiences, and charitable donations.

The goal of this analysis – which the New York Times calls “one of the most detailed accountings to date” of how corporations are spending their tax windfall – is not only to give greater context, but incentivize more companies to take more just and equitable action. As more and better data becomes available, the rankings will be updated. We hope this serves as an unbiased source of data on this critical issue.

Polling Results: Aligning with the Priorities of the Public

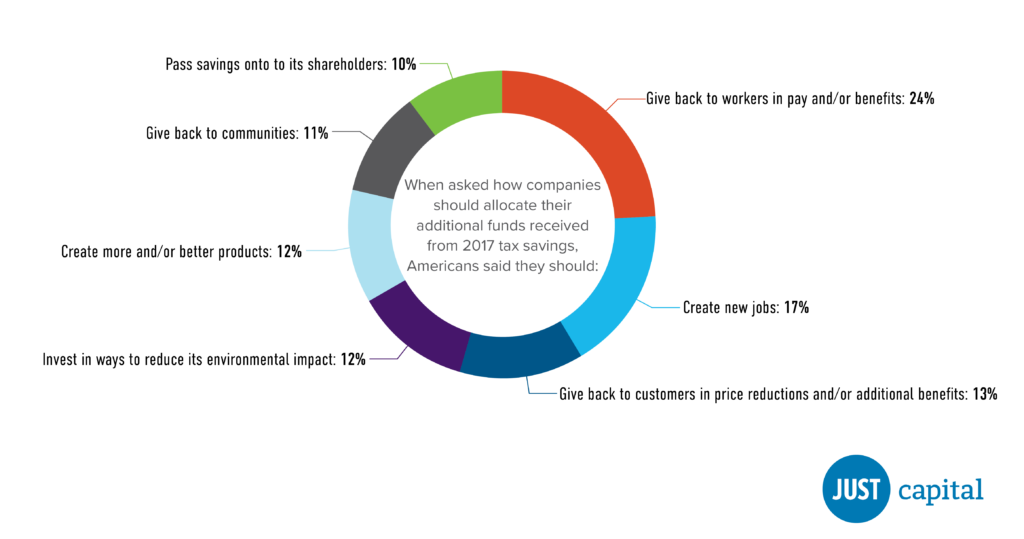

In 2018, as part of our annual survey effort, JUST Capital conducted a special poll of the American public, to better understand what people believe companies should be doing with their tax savings. When asked to indicate the percentage (ranging from 0% to 100%) of tax savings they thought should be allocated to each category, the results were:

The feedback is striking when looked at alongside our analysis above. While Americans agreed that 24 percent of savings should go toward worker pay and benefits, worker issues account for just six percent of how companies are actually allocating their savings.

Collaboration with Illinois State Treasurer’s Office

As part of our effort to inspire greater transparency around how corporations are using or intend to use their anticipated tax windfall, JUST Capital collaborated with the Illinois State Treasurer’s Office, and other institutional investors, including Sycomore Asset Management, Trillium Asset Management, CtW Investment Group, The Nathan Cummings Foundation, and Segal Marco Advisors, in a survey to the S&P 100 that asked how they expected to reinvest their savings from the Tax Cut and Jobs Act. The report, which details how 48 of the largest U.S. companies are spending their tax savings, was featured in Politico, and can be downloaded here.

Note About Utilities

In much of the country, investor-owned utilities have a monopoly, and state regulators allow them to charge rates high enough to recoup their costs and provide a return to their shareholders. So, when taxes go down, regulated utilities tend to pass a significant portion of their savings to their customers in the form of lower prices, as evidenced below:

Methodology & Ongoing Analysis

JUST Capital will track and analyze corporate announcements related to worker raises and bonuses, stock buybacks, capital expenditures, executive compensation, and other measures, and will update the Rankings with the aim of capturing a comprehensive overview of where the tax savings is going across corporate America throughout the year. Read more about the methodology behind the rankings here.

Making the Grade

Top performers are committing to long-term investments in workers, job creation, and strengthening local communities:

- Boeing announced that it to would invest more than 100 percent of its over $220 million in tax and repatriation savings estimated by JUST Capital, including $100 million for workforce training and development and $100M for “workplace of the future” facilities and infrastructure enhancements (both captured under Workers), as well as $100M in corporate giving (captured under Communities).

- FedEx announced that it would invest more than 100 percent of its nearly $400 million in tax and repatriation savings estimated by JUST Capital, including a $200 million investment in increased compensation, two-thirds of which will go to hourly team members (captured under Workers). In addition, FedEx pledged $1.5 billion over seven years to expand their Indianapolis hub (captured under Jobs).

- Apple, the largest U.S. taxpayer, announced that it would invest more than 100 percent of its $5.5 billion in tax and repatriation savings estimated by JUST Capital, including $30 billion in capital expenditures over the next five years driving the creation of 20,000 new jobs (both captured under Jobs).

- JP Morgan Chase announced that it would invest more than 100 percent of its $2.9 billion in tax and repatriation savings estimated by JUST Capital, including increasing wages to between $15 and $18/hour for 22,000 employees (captured under Workers), hiring 4,000 employees in new U.S. markets and for home lending, small business growth nationwide (captured under Jobs), increasing small business lending by $4 billion as well as personal loans to customers seeking affordable homes by 25 percent to $50 billion (captured under Products), and expanding philanthropic investments to $1.75 billion (captured under Communities).