What explains the market outperformance of JUST companies?

The answer may surprise you.

Since November 2016 through March 2019, the JUST U.S. Large Cap Diversified Index (JULCD) has returned 37.9%, outperforming the Russell 1000 by 3.3%. To further our overall mission, we want to explore why this is happening, and what some of the contributing causes might be.

In our October 2018 analysis, Looking for Strong Returns? Ask the American People, we examined the influence of six factors conventionally found to explain equity market performance – Value, Size, Momentum, Investment, Market, and Profitability – and found that most of the JULCD’s outperformance remained unaccounted for. This suggested that there is something else – something not captured by any of these traditional elements – that is responsible for the JULCD’s excess return.

A conviction that has underpinned our work since the beginning is that JUST companies are simply better companies because of the strength of their relationships with their core stakeholders and the competitive advantages this confers. The better we are at pinpointing the underlying issues, the more effective we can be in driving change.

The JUST Factor

Enter a seventh factor – the JUST Factor. By identifying it as an additional component, we can begin to evaluate its importance in explaining the JULCD’s outperformance and company returns overall. We define the JUST Factor as the difference in equity market returns between the top 20% and the bottom 20% of companies in every sector, as determined by the JUST Capital Rankings. In essence, the most just minus the least just, by industry.

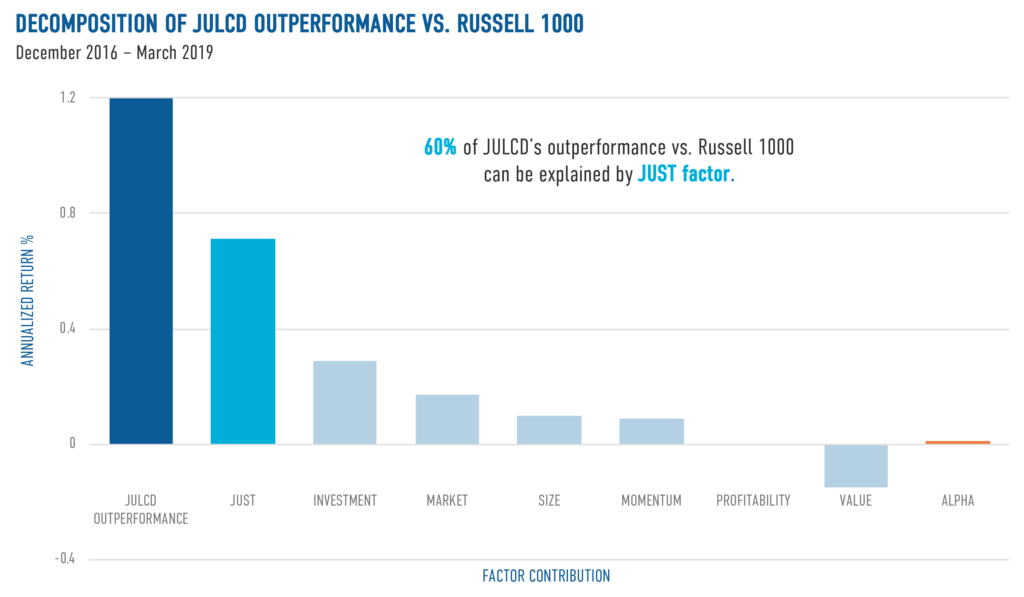

When we look at the decomposition of returns after including the JUST Factor, some striking results emerge. First, the “unexplained” alpha has now essentially disappeared, accounting for only 2% of the outperformance. Second, the JUST Factor has become the most significant driver of the outperformance, accounting for 60% of the JULCD’s outperformance. In other words, just business behavior is the principal reason for the Index’s outperformance. The traditional Fama-French factors are present, but their relative influence is muted.

Quarterly Analysis

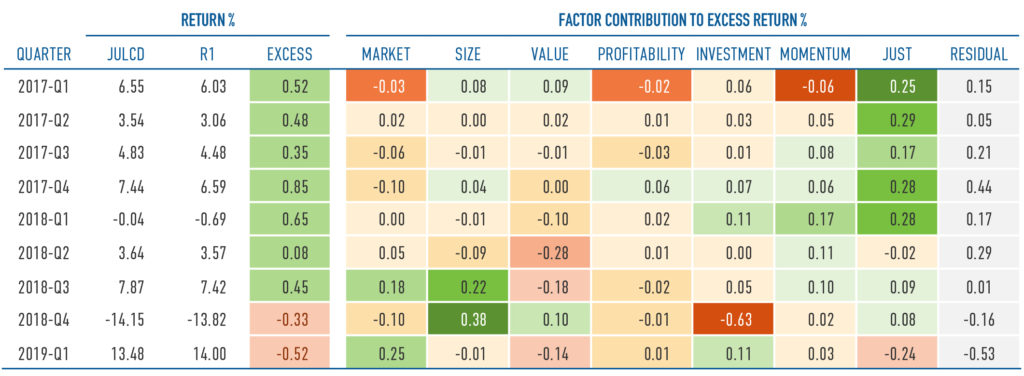

To get a more granular perspective, we broke down the results on a quarterly basis, to look at the relative contribution of the various investment factors, including the JUST Factor, to returns over time. Again, the results are striking (see table).

The JUST Factor is not only positive in seven out of the nine quarters evaluated to date, it is by far the most consistent contributor to returns quarter after quarter. In the fourth quarter of 2018, for example, when the JULCD slightly underperformed the Russell 1000, we see that the main performance detractor was the Investment factor, while the JUST Factor itself remained positive.

The JUST Factor analysis provides further specifics on the source of excess returns relating to just business behavior and tees up more detailed analysis that we’ll continue to unpack through our ongoing JUST Alpha series of what underlying aspects of these issues might be the most important contributing factors. Stay tuned for more, and download a PDF of the report here.

Interested in learning more? Sign up for the JUST Report, an essential weekly roundup of news and insights on the future of capitalism, and the movement to build a more just and equitable marketplace in America today.