The JUST Report: Should CEO Pay Be Tied To Stakeholder Value Creation?

It’s interesting to take a just lens to the recent spate of CEO pay cuts at Alphabet, Apple, Goldman Sachs, Intel, and JPMorgan Chase.

First, some context. In 1965, the ratio of CEO pay to the average worker was around 20:1. Last year, the average CEO-to-Median-Worker Pay Ratio pay ratio was 235:1. The average pay increase for CEOs from 2020-2022 was 31%, compared to 11% for the median worker.

We know from our polling and focus groups that Americans are unhappy with this situation. Almost nine in 10 have told us they believe the growing pay gap is a problem, and 73% said CEOs were paid too much. 72% even opined that companies should have CEO compensation caps, regardless of performance.

Typically, CEO pay is calibrated to the success of the business. If this is defined in terms of total shareholder return, it stands to reason that CEOs will be disproportionately rewarded when companies’ stock prices do better and disproportionately punished when they suffer (especially if their comp has a large stock component). This is what is happening at Intel, for example, where in response to a difficult fourth quarter the firm has reportedly cut CEO Pat Gelsinger’s salary by 25%, the executive leadership team’s salaries by 15%, VPs’ salaries by 10%, and mid-level managers’ salaries by 5%. It has also made other pay cuts across the company and let go of more than 500 employees in California.

But what if CEO and senior executive pay was tied more explicitly to total stakeholder value creation? What if – since we know Americans prioritize workers in particular – executive wealth creation was tied to worker wealth creation, or, say, the proportion of their workers rising above local living wage thresholds (to pick two key metrics)? Might that address the growing pay gaps Americans are so concerned about? And since stakeholder performance is so strongly related to long term financial performance, might it better orient companies for future success?

Be well,

Martin Whittaker

JUST 100 Stakeholder Performance Spotlight

This week we’re profiling #8 in our 2023 Rankings of Americans Most JUST Companies – Apple. Despite a lackluster earnings report yesterday, the world’s largest company has so far avoided layoffs. The tech company is first in its industry and has consistently held a top spot in our Rankings largely thanks to its industry-leading minimum wage of $22 per hour.

Apple conducts annual pay equity analyses by gender and race and ethnicity and reports that it has achieved 1:1 pay equity for all of its workers since 2017. The company also demonstrates an ongoing commitment to diversity, equity, and inclusion by publishing its EEO-1 report.

On environmental and climate issues, it focuses intensively on the environmental impact of its products, with a goal to create products with Net-Zero carbon impact by 2030. Apple has reduced the amount of single-use plastic in its packaging by 65% since 2015, while increasing the amount of recycled material in its products.

This Week at JUST

Richard Feloni, Editorial Director:

You’ve no doubt read plenty about greenwashing, but have you heard about “greenhushing,” the buzzword floating among the Davos set the past few months? Trendy lingo or not, it refers to a real challenge, where CEOs feel political pressure coming from both sides around anything potentially labeled as ESG, and so are choosing to stay mum about policies they’d previously want to celebrate. But that’s leaving on the table an opportunity for trust-building among stakeholders, Edelman’s US Head of Social Impact & Sustainability, Alex Heath, told me.

He drew from his ongoing conversations with corporate leaders around the country to offer an alternative approach, which we explore in a new piece on JUST’s site. Heath doesn’t want to see CEOs abandon positions of stakeholder leadership, but also thinks it’s time they bring focus to what social issues they’re choosing to speak and act on. “I think greenhushing can force a course correction in the space,” he said.

Quote of the Week

“As JUST Capital’s own research has made clear, Americans across every demographic category want companies to invest in their workers. That means ensuring every job is a good job, where economic stability, economic mobility, and equity, respect, and voice are the building blocks for a more just future of work and workers. This is not utopian; this is in reach, and if corporate America can lead in this way, listening to workers will be an act of not only repairing our economy, but growing our democracy.”

- Sarita Gupta, Director, Future of Work(ers) at Ford Foundation

Must Reads of the Week

Black workers, young workers, and the lowest earners on the income scale saw the largest wage gains last year amid a tight labor market. The Wall Street Journal reported on pay increases and the slight relief they provided to those demographics.

This Harvard Business Review editorial explained that despite the abundance of layoff news, the labor market remains tight because there are still not enough workers and instead of an abundant talent pool, companies are fighting over a tiny talent puddle.

And on the subject of layoffs, Fortune detailed all the hidden costs that employers should be weighing, from the loss of knowledge to plummeting morale and productivity among remaining employees.

Axios wrote about the sad state of paid family leave for American workers: Only one in four workers in the private sector has access to the benefit and 40% of workers aren’t even covered by the Family and Medical Leave Act of 1993, which guarantees 12 weeks of unpaid leave to employees at companies of 50 or more.

In a roundup of just business news, Insider reported Chipotle plans to hire 15,000 workers, and will continue its career progression campaign. The company shared it made 22,000 internal promotions last year, and over 90% of management hires were selected from existing employees. CNBC reported that Jetblue pilots agreed to a contract extension that locks in 21.5% in raises over the next 18 months.

NYC Mayor Eric Adams announced that Uber and Lyft will be required to convert to a 100% electric fleet by 2030. The rideshare companies have welcomed the move, even though it is estimated to affect 100,000 vehicles.

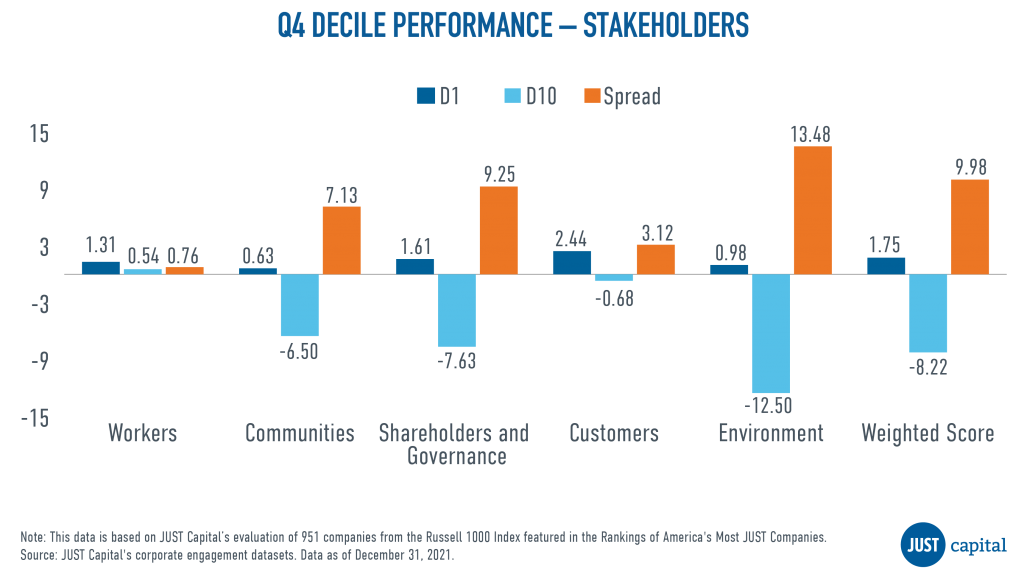

Chart of the Week

This week’s chart looks at the market performance of Russell 1000 companies with the highest and lowest stakeholder performance in Q4 of 2022. High performance on all five of the stakeholders JUST Capital tracks delivered positive market performance, despite continued turbulence. The Environment stakeholder delivered the best performance over this period with a long-short spread of 13.48%, followed by Shareholders and Governance stakeholder.