Why Workforce Metrics Matter and the Challenges of Limited Disclosure

Introduction

Human capital management (HCM) is an important consideration for the many institutional investors who believe that analysis reflecting how a company’s workforce is managed can impact long-term value. Institutional investors are increasingly recognizing the potential materiality of workforce-related metrics such as turnover, strong benefits, diversity, health and safety, and pay equity, and many believe these factors provide insights into intangible value, operational stability, talent retention, and innovation capacity. However, institutional investors often struggle to acquire the right data to effectively compare individual firms and industries. Additionally, in the United States, HCM disclosures remain limited and are mostly subject to disclosure only at the company’s discretion. For decades, before expanding principles-based rules several years ago, the Securities and Exchange Commission required only the disclosure of one specific metric – the number of employees – and even that failed to account for gig workers and contractors or to adequately delineate other non-traditional employment models, such part-time or seasonal workers.

This report synthesizes insights from 14 institutional investors – seven asset owners and seven asset managers – who manage and invest assets for funds ranging in size from $50 billion to the trillions. It explores how investors approach HCM data, the challenges posed by limited disclosure, their view on the materiality of HCM data, and how they navigate these barriers in their stewardship and engagement practices.

Methodology

This report is based on interviews with 14 institutional investors, divided equally between asset owners and asset managers. Participants represented a range of management styles, including passively managed portfolios tied to indices and actively managed funds that consistently incorporate HCM metrics into their strategies.

The seven asset owners participating in the survey included the Office of the New York City Comptroller, the Office of the Illinois State Treasurer, and the California State Teachers’ Retirement System (CalSTRS), while others elected to anonymously respond. Asset owners ranged in the amount of internally managed assets they held, from as little as none to more than 90%. The seven asset managers participating included Schroders PLC, Zevin Asset Management, EOS North America of Federated Hermes Limited, and four anonymous respondents; they tended to manage all of the assets they held internally, and more than one manager provided engagement and stewardship services to other funds for assets that they did not control.

The topics covered in the survey interviews included the investors’ use of HCM data, their views on its materiality, and the challenges they face in accessing actionable information. Investors shared their thoughts candidly, often drawing on specific examples from their work.Since participation was voluntary and the report’s primary stated focus when recruiting participants was HCM metric issues, funds that value HCM and are willing to provide their time and perspectives on the issue are likely overrepresented here. For that reason, the report likely has a bias toward self-selecting the funds most interested in HCM issues. While the respondents may not be representative of the average institutional investor, there is still value in understanding their perspective since several of the HCM topics do receive high levels of support from shareholder proposals. These areas receive tremendous attention and public commitments from companies during engagements, and they highlight central HCM topics that funds with less of a focus on HCM issues do pay attention to (albeit to a lesser extent), as evidenced by shareholder proposal voting and voting policies throughout the investor sphere. Ultimately, the perspectives shared in this report represent the vanguard of investor work on HCM issues while not necessarily representing institutional investors as a whole.

How HCM Fits Into Broader Stewardship Themes

Many investors see HCM as interconnected with other stewardship issues. Each investor was asked to name their fund’s top priorities so we could understand where HCM issues fit in with their broad stewardship goals. Overall, their responses show that HCM’s prominence in investor priorities reflects its far-reaching implications across various dimensions of stewardship and performance.

The key themes highlighted in this section illustrate how the participants prioritize stewardship issues that span governance, environmental challenges, workforce management, and social equity. Together, they reflect a holistic approach to managing risk and creating long-term value across their portfolios.

Governance and Board Oversight

Governance remains a foundational concern, encompassing board diversity, effectiveness, independence, and accountability. Investors prioritize ensuring that boards are equipped to oversee key risks and drive long-term value creation. Several investors emphasized the importance of diversity in leadership, most commonly expressing the need for racial and gender diversity but also naming other categories like diversity of age, perspective, and thought. Most often investors cited:

- Board diversity

- Executive compensation

- Governance structure

Climate and Environmental Risks

Several respondents reported prioritizing climate-related risks and opportunities, particularly in industries transitioning to sustainable models. Metrics like carbon accounting, water usage, and biodiversity impact were frequently raised. Just transition issues represent a nexus between climate and HCM because as climate-responsive policies dictate changes in energy sources and use in particular, many companies and investors are also focusing on how to lessen the affected industries’ negative impact on communities and workers, including how to support these groups in transitioning to other jobs and industries. Most often investors cited:

- Net zero and methane disclosures

- Water risks

- Nature and biodiversity

Human Capital Management (HCM)

Investors widely recognize workforce-related issues as central to operational stability and long-term value creation, citing turnover, diversity, health and safety, and freedom of association as critical metrics. Additionally, they connect workforce health and safety to operational integrity and productivity, emphasizing the need for metrics on injury rates, safety policies, and employee well-being. Most often investors cited:

- Turnover

- Health and safety

- Compensation and pay equity

- Workforce resilience

- Healthcare issues and benefits for workers

- Freedom of association for workers

Diversity, Equity, and Inclusion- (DEI-)Related Issues

Although DEI-related issues have become a lightning rod for many companies and investors, the surveyed investors’ interest in workforce culture, engagement, productivity, training, and satisfaction – factors that underpin many serious DEI programs – remains relatively intact. Several participants expressed the belief that racial and gender diversity can drive innovation and talent retention and that the diversity of the board and management ranks are meaningful metrics to assess a company’s efforts on representation and its governance strategies. These participants argued that better data is needed on representation, recruitment, and retention across demographic categories, and they reported discussing these issues during company engagements and in data requests to companies. Most often investors cited:

- Representation and inclusion

- Data transparency

Corporate Accountability and Human Rights

Corporate accountability, including transparency in lobbying and aligning policies with stakeholder interests, emerged as a common theme. Some investors also tied this to broader human rights concerns. Most often investors cited:

- Lobbying and policy alignment

- Human rights

How Investors Use HCM Data

Institutional investors incorporate HCM data into a variety of activities, from proxy voting to engagement and investment analysis. However, the participants expressed that the lack of standardized disclosures limits the effectiveness of these efforts.

Specifically, when respondents were asked to agree or disagree with the following statements:

- 57% agreed that the lack of standardized HCM data negatively affects their investing decisions.

- 93% agreed that the lack of standardized HCM data negatively affects company engagements.

- 71% agreed that the lack of standardized HCM data negatively affects proxy voting decisions.

Key Metrics

Investors highlighted several metrics as particularly valuable for understanding workforce dynamics:

- Turnover rates: The surveyed investors universally cited turnover as a foundational metric for workforce stability. Profitability is tied to both keeping training costs low and keeping employees who are experienced and good at their jobs; these make a real difference for productivity. One asset manager explained: “Turnover is the only metric that runs through the whole model. UPS, Amazon, or Macy’s—turnover will be very different, and it must be sub-industry–relative to be decision-useful. But even turnover isn’t reported consistently.”

- Workforce diversity: Gender, race, and ethnicity data helps investors evaluate inclusivity and talent management. It also tells investors whether companies are rationally evaluating prospective employees and promoting from within their talent pool. This affects turnover and productivity because employees will often just give up or leave if they see a lack of promotion for people who look like them. One asset owner emphasized the importance of EEO-1 reporting in particular: “Every company should publish their EEO-1 report. We want demographic information, recruiting, promotion, and retention broken out by EEO-1 categories. It’s the baseline for understanding diversity and inclusion.”

- Health and safety: Metrics like injury rates provide insights into operational risks. Ongoing problems in industries with dangerous jobs point to mismanagement and underinvestment in programs that protect financial performance, exposing investors to higher litigation risks, lower productivity, and higher turnover as employees seek jobs elsewhere that don’t pose recurring risks to their health. One asset owner said, “We seek to support and improve the well-being of employees as part of [a] human capital management strategy that includes providing a safe and healthy workplace.”

- Employee benefits: Benefits and quality of life programs for employees, such as through paid leave programs, make a big difference in whether employees feel valued and whether they stay at a job. As the labor pool tightens, benefits make a big difference to employees’ health and well-being and to their families. These programs are an essential employee attraction and retention tool, but often, there isn’t much in the way of disclosures for investors. Marina Severinovsky of Schroders said, “Many companies push back on reporting unadjusted gender pay gap data, as they believe it can be misinterpreted, and workforce pay data including wages and benefits. Some companies claim that due to the complexity of the business structure it would be challenging to disclose standardized benefits.”

Marina Severinovsky of Schroders further explained how HCM ties into financial outcomes that investors can use to outperform other managers:

From our research on HCM, we found three key areas that impacted alpha greatly: employee sentiment and culture, board diversity, and employee compensation and turnover. These metrics link together to form a fuller picture. Compensation fairness, living wages, inclusion, and culture all contribute to employee sentiment, which is linked to turnover and directly impacts P&L.

Emily DeMasi of EOS at Federated Hermes Limited spoke about the intersection of metrics like turnover and demographic information, as well as its usefulness for assessing the quality of workforce management. When their stewardship team has that information, DeMasi said, they take cues from those disclosures and it impacts their votes on board members and shareholder proposals:

Our decisions are more around stewardship and voting decisions, and similarly, it would help us understand where gaps exist in talent. If you would break down a turnover number into more granular demographics, it could get us to whether we should really be pushing for inclusion instead of just diversity from a stewardship standpoint, and as far as voting decisions, we see more and more shareholder proposals related to worker voice, whether that be from a very basic freedom of association, neutrality shareholder proposal, and up to including a worker on the board. There’s a wide spectrum between those two things, but if we understood how well or poorly a workforce was being managed, then it would directly influence whether or not we would end up supporting those types of proposals or not, and whether we’d want to hold a board member [who’s] either part of the committee charged with overseeing these issues, or the chair of the nominating and governance committee. There’s not enough data out there to really inform those decisions the way we’d prefer.

One asset owner spoke about worker safety and its importance in ensuring that the company is managing employees well, keeping litigation costs low, and encouraging employee retention in dangerous fields:

Materiality is obvious in some industry- and company-specific metrics like cell phone towers owned by REITs and fatalities for workers. It is very complicated because contractors versus employees versus temporary workers hired by the property management company for that specific tower area are disclosed differently. Different terminology that companies use differently, but fatality rates are definitely material for companies and industries where injuries are most likely, like mining, construction, etc. We know these are material, but we don’t have the data. OSHA guidelines leave room for variability in what and how companies disclose, and it is resource intensive.

One asset owner noted that the information they look for spans multiple categories and enables them to fully understand how well a company is managing its workforce and policies by looking very broadly at a variety of data points:

We’re always looking for transparency. Every company should publish its EEO-1 report, disclosure of issues that show effectiveness of the company’s efforts to manage things like harassment and discrimination. We want demographic reporting, and information related to efforts in recruitment, promotion and retention by EEO-1 categories. We want to know about inclusive policies and benefits and whether the company collects and protects private information. We are in favor of freedom of association policies and labor and human rights reporting. The issues are different at different companies so we need a wide variety of information to compare.

Will Pomroy of Federated Hermes Limited explained their comprehensive evaluations across several metrics and on both an absolute and relative basis to peers:

There is definitely a lot of case-by-case analysis on what is particular to an individual business or sector. That said, within the ESG tear sheet that our analysts produce, there are common metrics that are looked at for each name to be considered for investment. They include employee turnover rates, employee accident rates. workforce diversity metrics, broken down by workforce as a whole and at management level, and an average pay or median pay metric included. All of those metrics are looked at, both on an absolute basis and on a relative-to-peer basis to help contextualize.

Another asset manager spoke of their detailed analytical process that compares metric performance among sub-industry peers:

We use many metrics, like turnover, professional development measured by training hours, percentage of work represented by collective agreement, health and safety, such as total recordable injury rate (TRIR) and fatalities, health and safety policies. We have our own proprietary models so we are only using the underlying data from the rating agencies providers and we go down to the GICS sub-industry. We have our proprietary materiality map of the material risks and opportunities from across the sub-industries. And we include the actual academic or industry evidence that backs it up so it’s super transparent for our investors. We go metric by metric across each one of the 163 sub-industries to determine if we have statistically significant enough coverage of this metric to include it into our model.

Several investors reported being very responsive to controversies that arise among portfolio companies. One asset manager described their HCM engagements as being led by idiosyncratic company issues or industry-level effects for metrics that don’t necessarily rise to the portfolio level, saying, “We really focus on controversies and issues that are material to the industry or the company in particular. We don’t do thematic engagements on HCM across our portfolios.”

Costs of Collecting and Analyzing HCM Data

The lack of consistent HCM disclosures imposes significant costs on investors, both direct and indirect. Some firms invest heavily in third-party data providers, while others devote substantial time and staff resources to filling information gaps and evaluating non-standard disclosures. Most investors dedicate significant time and money to collecting and analyzing HCM data but are unable to provide specific costs because they don’t segregate costs from their other stewardship data and engagement activities. However:

- One asset manager reported annual expenditures nearing $1 million for HCM-related data and analysis.

- Some asset owners reported spending large amounts of staff time on HCM analysis, representing significant opportunity costs related to staff time.

- Several asset owners estimated a more modest $75,000 for direct and indirect costs, while several reported paying around $10,000 annually in direct costs for data subscriptions specific to HCM metrics.

One asset owner detailed the inefficiencies created by inconsistent data:

It’s hard to quantify, but in terms of time it requires five to seven hours a week in terms of trying to amass and validate info. EEO-1 report searching is time-consuming because it’s not in a standardized place or location. In terms of opportunity cost, it’s very hard to benchmark companies against each other, to target the worst versus best, which is a good thing to know as a universal owner. Instead, we are left to guess who is a laggard, and ultimately that’s not impactful.

Challenges With Current HCM Disclosures

Investors participating in the survey almost uniformly described the state of U.S. HCM disclosures as inadequate, citing a lack of standardization, incomplete data, and companies’ resistance to sharing meaningful metrics. As one asset owner articulated:

The state of disclosure is absurdly deficient. Because it isn’t standardized, you can’t use it for making investment decisions. Even for stewardship and voting decisions, the lack of clarity means sometimes spending weeks drafting proposals and negotiating, only to end up with data that isn’t decision-useful.

Another asset manager summed up the frustration with the current state of HCM data:

It’s inconsistent and sparse, varied by industry and maturity of the company. Most of the data that is available are not the best indicators of performance or risk/opportunity management. It’s hard to gauge what is good performance versus bad, which metrics are comparable versus those that vary due to industry or business model considerations.

Emily DeMasi of EOS at Federated Hermes Limited highlighted the deficiencies in the way data is disclosed:

It’s just fragmented and uncomparable. We see more data being disclosed, but not in a way that allows us to make the decisions that I think investors want to make on that data. If I could only have one data point, what would it be? It would be turnover, and it is shocking how few companies actually disclose a turnover number, voluntary or involuntary. When you see that number over time, it gives you a lot of insight into how well the human capital is being managed in any company and then you would be able to see it across peers.

Will Pomroy of Federated Hermes Limited spoke about the large differences he sees in the U.S. versus U.K. markets:

I see, sitting here in the UK, the basic lines in a financial statement such as personnel expenses are easily identifiable and straightforward to get a sense of, actually, what is the cost of labor for that business and how productive is that time and how does that then interrelate with employee turnover rates and accident rates and the like. You can begin to get a reasonable first impression of the company’s human capital management practices, whereas in the US, I think one struggles to begin to piece together that initial picture to then be able to dig deeper to form a more detailed view.

Another asset manager noted that it seems like progress has been slow for certain movements:

It’s very weak. The HCM required disclosures in the proxy statement from the SEC is not uniform, so it makes it difficult to use as a point of comparison and we don’t have a lot of other information. We have spent a lot of time trying to get companies to disclose racial and ethnic composition of the board and that seems like it should have been solved many years ago. We’d like to be talking to companies in depth about their workforce issues but there’s just very little information out there.

Karen Kerschke of the Office of the Illinois State Treasurer added that the lack of data creates challenges in engaging with companies:

During engagements, companies will often assure us that they are performing better on HCM than other companies, but there is no way to verify such claims without public disclosure that is comparable between the company and its peers.

One asset manager stated:

Within human capital, there are questions like, are there safe and lawful working conditions, are there whistleblower mechanisms, protection of freedom of association? That’s baseline. How are they from an industry standard perspective, looking at their compensation and benefits, what is their strategy around that in terms of board governance, and then in best practice, what are their talent pipeline initiatives? So we’re looking at it a couple of different ways because you just can’t quantify it with one.

Another asset manager spoke about some positive changes in disclosures over time:

We have been pleased to see an increase in qualitative disclosures on HCM and DEI, and appreciate that many of the largest employers in our portfolio disclose in alignment with our guidance. We find Ethan Rouen’s research on the relative lack of HCM disclosures across the market useful.

Several investors cited the work of the Human Capital Management Coalition (HCMC), a network of over 30 institutional investors that advocate for four foundational HCM disclosures. One respondent from an HCMC member, Marina Severinovsky of Schroders, noted:

U.S. companies disclose HCM information in their 10-K forms, however the narrative presentation of this information and the breadth of topics included make it difficult to compare companies. More standardized disclosure would enable investors to make more informed assessments of companies’ human capital management performance, including:

1. how many workers, including employees and independent contractors (disaggregated) the company uses within its direct operations;

2. total cost of the workforce, including wages, bonuses and other benefits, presented in a way that evidences a discernible through-line from the company’s audited financial reports to issuer disclosures;

3. turnover, disclosed in a disaggregated manner to separate voluntary and involuntary turnover, accompanied by a description of management’s actions to attract and retain workers, and build an inclusive culture; and

4. diversity data, including diversity by seniority (such as required through annual EEO-1 reporting and gender pay gap data), sufficient to understand the company’s efforts to access and develop new sources of human capital and any strengths or weaknesses in its ability to do so, particularly as it relates to work to foster an inclusive culture. These disclosures are important to inform the investor view of how a company is building a diverse and inclusive culture and exposure to litigation risk.

What Metrics Investors Would Like to See Companies Report

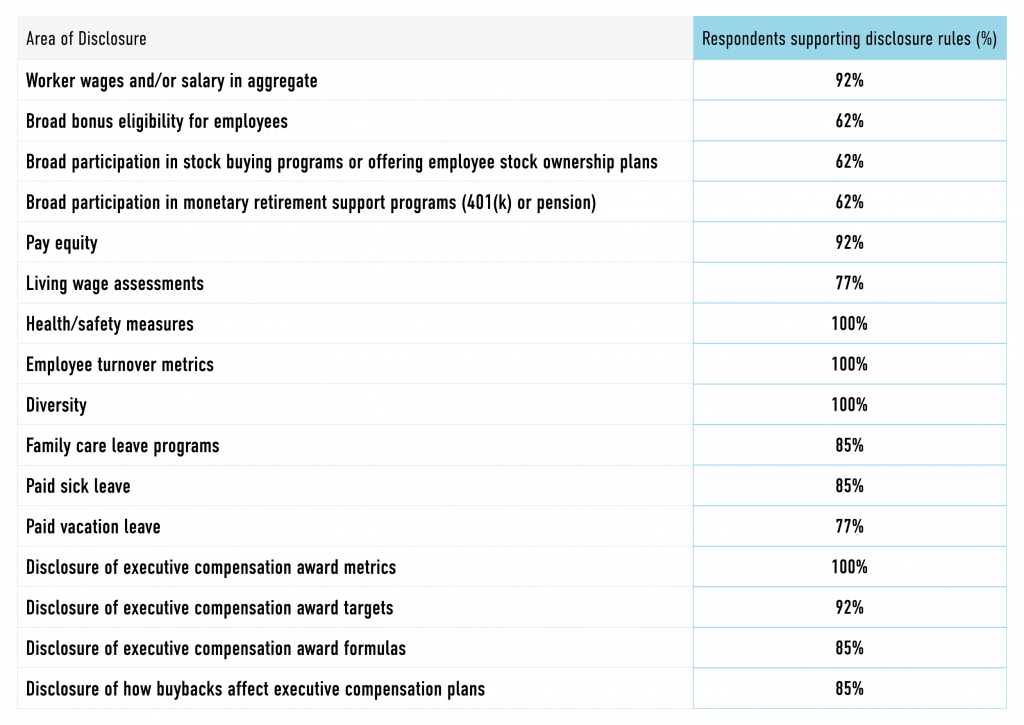

There is substantial support from the surveyed investors for enhancing required disclosures to make HCM data more available, clear, and comparable. We asked which of these metrics and data points participants would like to see disclosed under rules that would make them clear and comparable among companies, and as the following table shows, investors were highly supportive for most disclosures of pay and benefits.

The Materiality of HCM Data

Investors view HCM data as material across industries, though the relevance of individual metrics varies by sector. For example, workforce safety is critical in manufacturing, while diversity and inclusion are prioritized in technology.

Rekha Vaitla of CalSTRS tied HCM data to risk mitigation:

Turnover, pay equity, benefits information, and training and development are critical for understanding a company’s stability. These metrics directly inform our view of long-term risk and opportunity. For us, it’s a calculation of risk; we see that there is risk here that we need to mitigate for beneficiaries. We need to understand what is the stability of the companies that we’re invested in and what is their ability to retain workers and to grow and retain value in the long term.

One asset owner emphasized the importance of comparability:

Materiality comes from being able to benchmark. Without standardized data, we’re left guessing. Comparisons between companies are essential for identifying risks, but we can’t do that without comparable information from all companies.

Marcela Pinilla of Zevin Asset Management said:

Rate of turnover, and rate of retention and promotion of diverse talent (broken out by gender, race/ethnicity) tells a workforce story. Do associates or executives of color who join the company stay in their job? Do they get promoted? We also want to get insight into the bigger picture of job quality. This includes wages and benefits like paid sick leave, reproductive care access, pay equity, and anti-competitive practices like noncompetes in employee contracts that hinder wage growth and job mobility. Disclosure is the baseline request so that investors and stakeholders have decision-useful information to analyze and evaluate progress, and it’s also important to factor in qualitative information such as stakeholder input and employee feedback.

Marina Severinovsky of Schroders noted several metrics that her organization believes give companies a competitive edge in workforce management:

We identify human capital management as a priority issue for engagement, noting that people in an organization are a significant source of competitive advantage…Several metrics we consider material [are]: Paid time off and wider benefits including sick pay, company culture/sentiment, number of employees, total cost of workforce, voluntary and involuntary turnover, and workforce diversity data. We see these metrics having a direct impact on company performance, and companies can create a key competitive advantage by treating them as material.

Karen Kerschke of the Office of the Illinois State Treasurer noted the risk to investors from poor management of HCM issues:

Workers are the most important asset for any company. When companies recognize this and treat their employees well, they are better positioned for long-term success and to unlock sustainable value creation for their investors. Unfortunately, there have been alarming trends among some of the largest companies in the United States and elsewhere to treat workers more as disposable commodities than as vital assets. This includes tolerating high employee injury rates, turnover rates, subverting labor standards, or hiring contract workers with limited protections. Trends such as these represent poor human capital management practices that can create material operational, legal, regulatory, and reputational risks that can lead to depressed financial performance.

Multiple participants brought up the difficulty of defining what is material in terms of HCM metrics before having access to the data. Emily DeMasi of EOS at Federated Hermes Limited stated:

So, we would like to look at the total cost of the workforce, look at workforce demographics and then, the two most basic things that you think every company would report consistently, and comparably, is number of employees, including part time, contract, gig or consulting workers, however that is defined. And lastly the really key metric of turnover. But until we have those reported on a regular basis and people are making decisions on that, it’s honestly really hard to say which are the most material. It’s almost like the chicken and the egg. So those are the issues that have consistently come up as to what asset owners believe to be the most material for making decisions, but until we are enabled to see it and start making decisions on it, that’s the only way to sort of prove the case and prove that they are the most material.

Another asset manager worried about the data not being available to be rigorously tested in academic study, as well as being known to some in the market (such as employees) but not being actionable and known to investors:

I think there is an assumption of materiality because for a lot of companies knowledge is stored with the staff, but we don’t have access to study that because the data is not public. So I can’t point to academic studies, but if we had the data out there, the academic studies would follow and then we would be able to show materiality. Anecdotally, one of my relatives left a job because she felt like she hit a glass ceiling, and when she looked internally at promotions and retentions, she realized every senior-level woman had quit within the last three years. And so while she didn’t have any personal experience with gender discrimination, she inferred that the lack of females in leadership meant that she wouldn’t be able to advance at the company. So that kind of information is helpful for analyzing recruitment and retention. The employees know, and look at it often. And they are using it for decisions. As an investor on the outside, we don’t have that information.

Engagement and Company Responses

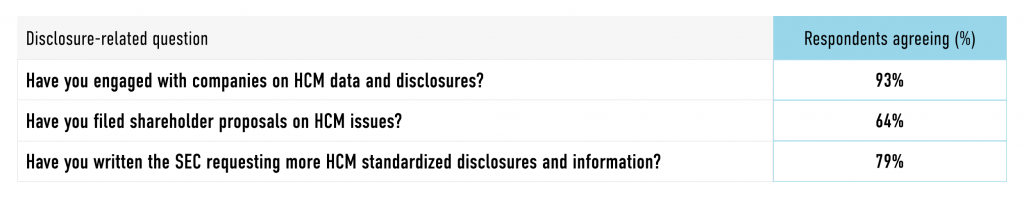

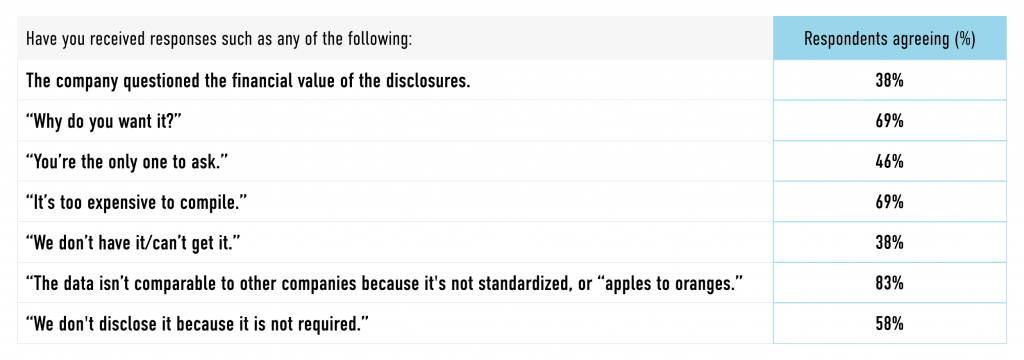

Investors frequently engage with companies to advocate for improved HCM disclosures, but they often encounter resistance. Common pushbacks include claims that data collection is too expensive or that metrics lack comparability.

Several investors said “it’s not required” is the most-heard rationale from companies for not disclosing HCM data. Some participants said companies question the value of certain disclosures, like metrics on the board and workforce representation along racial and gender lines.

As one asset owner remarked:

Engagement responses from companies are enormously variable. Companies with strong HCM stories are more willing to disclose, but others are resistant, especially in the U.S., where disclosure requirements are weaker.

Investors often hear similar responses from companies. When we asked if they’d heard any of the following responses to their requests for disclosure, participants most often said they heard that the company didn’t want to release information because it wasn’t “standardized” or “apples to apples.”

Conclusion

HCM data is critical for improving investors’ understanding of corporate value, returns, and risk mitigation, yet the current state of U.S. disclosures limits investors’ ability to benchmark companies. The asset owners and asset managers participating in this study believe that standardized reporting frameworks that include metrics like turnover, diversity, pay equity, and safety data are essential to closing these gaps.

Many investors believe that workers are the most important asset for any company, which is borne out in part by the rise of intangible asset value at companies over time. When companies treat their employees well, they’re more competitive with peers and better positioned for long-term success. Standardized disclosures would allow investors to identify leaders, hold laggards accountable, and drive sustainable value creation. By improving transparency, U.S. companies allow investors to make more informed decisions and foster a stronger, more sustainable economy.

Investors in our survey are eagerly waiting for companies and regulators to step up to improve the quality and quantity of HCM data so that they can make investing and stewardship decisions with deeper knowledge and greater accuracy. In the meantime, they are expending considerable money and effort to glean what they can from non-standardized reporting, external data providers, and their own analysis and direct conversations with corporate leaders.

Ultimately, these investors are seeking clear and comparable metric disclosures by all companies on key metrics. By addressing these gaps, the U.S. can align its practices with global standards, enabling more effective stewardship and fostering a more sustainable and equitable economy.