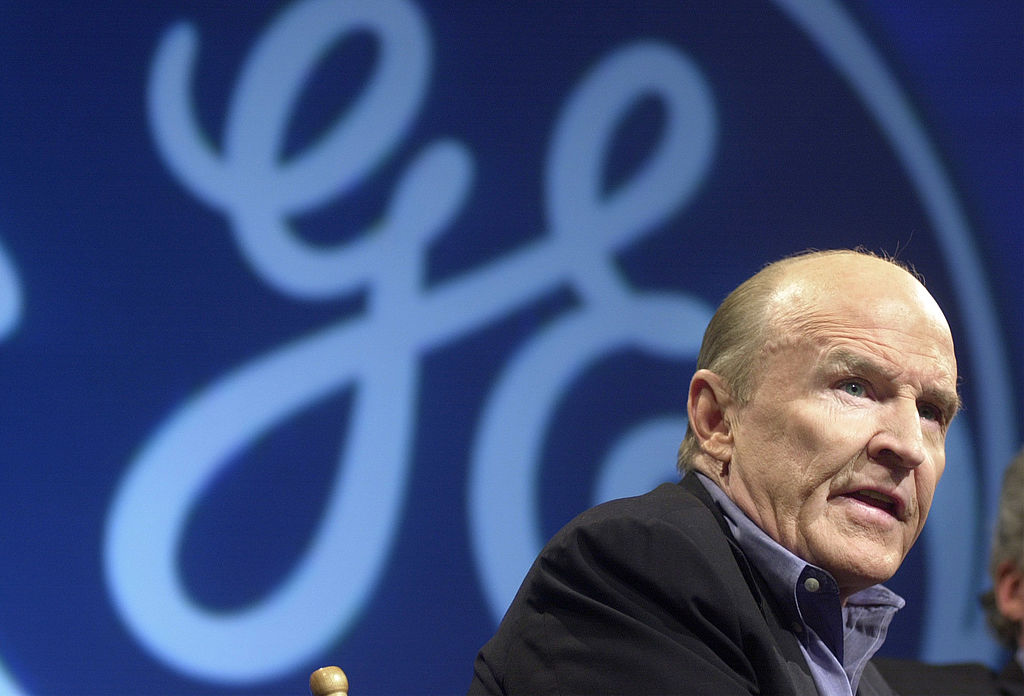

When Jack Welch retired as chairman and CEO of General Electric in 2001, he ended a 20-year tenure that took GE from a valuation of $14 billion to $600 billion, making it the most valuable company in the world. Over those two decades, his brash management style, ruthless cost cutting, and creative financial engineering set a new standard for what a CEO could and should be. Fortune captured popular sentiment across corporate America when it named him “Manager of the Century” as he transitioned into retirement.

Two decades later, in a moment when American business is increasingly rejecting business norms of the past 40 years, New York Times writer David Gelles is arguing that we should reconsider the legacy of what he deems the single most influential corporate leader of that era. The title of his book pulls no punches: “The Man Who Broke Capitalism: How Jack Welch Gutted the Heartland and Crushed the Soul of Corporate America – and How to Undo His Legacy.”

Given our focus on guiding corporate America toward a stakeholder capitalism model supported by the majority of the public, we were of course interested in Gelles’ argument. We sat down with him to discuss why he thinks Welch’s career, and the norms he established, were so harmful to the country, and how exploring that story can illuminate the path we should instead pursue.

The following transcript has been edited for length and clarity.

When I first saw the title, I thought, “Oh wow, that’s a hot take, putting this all on Jack Welch,” but I did see as I was going through it, that OK, I see your point and the tremendous influence that he had and how he fit into this. But you also recognize that there were so many different factors – philosophically, politically, legally, societally – that went into this shift that we saw in capitalism and developing a new norm for corporate leadership. Can you give me your overview of where Jack Welch fit into all of these different factors that reshaped the way we do business in America and then the world?

Well, as you acknowledge, the moment right around when Jack took over was a period of immense change in the American economy and the global economy at large. There’s no doubt that the last two decades of the 20th century were going to be a heck of a lot different than the 50 years that came before, but there’s a difference between ideas and action. You alluded to some of the philosophical and economic and ideological changes that were afoot, in the form of some of the Friedmanites and the Mont Pelerin Society, people reevaluating the role of business in society, those questioning Keynesian Economics.

But it was only when Jack took over GE that we actually saw what that ideology looked like in practice. He was the one with his singular mix of ambition and a sense of impunity, and control of one of the largest and arguably the most influential company in the country. He was able to not only radically transform and reset norms at GE, which was this standard bearer, but because of that influence, also bring the rest of the economy along for the ride, essentially setting a new standard by which CEOs and executives were evaluated.

When you’re looking at this period leading into the ‘80s, you had stagflation and you had the rise of globalization. Clearly the preceding singular moment of what could be considered a “golden age of capitalism,” that was always going to be temporary, along with America’s role in the world during this postwar boom. Companies and business in general could seem great for those that were actually allowed into that sphere, but things were changing and had to change. Was there a moment where things started to correct too much or swing too much to the other side?

Jack recognized that things needed to change, but I argue that he radically overreacted. And if it was the case that companies did need to become less bureaucratic, less thick with middle management, his solution was simply to fire people en masse. If it was the case that American industry was inevitably going to begin outsourcing, he went whole hog. He went and started putting factories on trucks and sending them down to Mexico as quickly as he could. It’s important to remember that while we’re talking about these large abstract economic forces, ultimately what we’re talking about are the decisions made by certain men and their effects on real people.

And when I think about it in those much more human and practical terms, it’s easier for me to entertain a counterfactual and imagine a world where yes, Welch made a company like GE more efficient, but he did it without laying off 120,000 people in his first three years.

He didn’t do that because he had to, it was not because the company was unprofitable – GE had just recorded a billion dollar profit the year before – but because he wanted the company to be more profitable. He wanted to boost the EPS [earnings per share] and thus began the game that unfortunately so many companies and CEOs are still playing, which is just this exercise in trying to do whatever they think Wall Street wants to see, to keep the stock price going up. That, sadly, is the world we still live in today,

A quote of Jack’s from his retirement, and it was even in Lynn Stout’s “The Shareholder Value Myth,” is when he said, “shareholder value is the dumbest idea in the world.” How did he square his worldview with that statement?

The context of course, is that through his actions, Welch became essentially the apotheosis of the CEO who seemed to be obsessed with shareholder value above everything else, and he made statements to this effect during his time as CEO. In his autobiography, he effectively parrots Milton Friedman and says, “The purpose of a business is to increase its profit.”

When the Wall Street Journal asked him what he was most proud of upon his retirement, he said that making GE the most valuable company in the world. This was a guy who throughout the course of his career was relentlessly focused on the stock price and did everything he could to drive it upwards. Then there came this moment in 2009, when in conversation with my former colleague Francesco Guerrero at the Financial Times, he said shareholder value is the dumbest idea in the world.

That to me was one instance, but by no means the only one, of his grand campaign to shape his own legacy in retirement. And by that point, because of the financial crisis, I think it was clear to him, even if he might not say it in such stark terms, that an economy that focused on shareholder value above all else was having a hell of a lot of problematic consequences in the marketplace. I think we can look at other statements he made in retirement and also take them with a grain of salt. He tried to refashion himself as a management guru who prided himself on his emotional intelligence, and you can ask just about anyone who worked closely with him and that’s not the terms in which they’d describe Jack Welch’s management style. He understood that people would be assessing his legacy and I think this was one example where he tried to maybe walk back some of his most nefarious contributions to the economy we live in today.

There’s a section in the book where I was familiar with a lot of the stories in isolation, but when they’re brought together, it was striking that when you follow all of his acolytes’ later careers as CEOs, inevitably the majority of them just tanked the companies they were leading when they tried to mimic Welch’s management style. Going back to Welch himself – let’s take a hypothetical situation where he doesn’t retire and doesn’t age, and stays on as CEO beyond 9/11 and goes through the financial crisis and its fallout. Would GE still have crumbled under him the way it did under his successor Jeff Immelt, or did he have a magic ability to keep everything under his spell, essentially?

These are great thought experiments. I recently had an almost identical conversation with Andrew Ross Sorkin. Andrew believed that Welch did have a unique ability to read the moment in a really special way, and believed that given the opportunity, Welch might have been able to meet the moment, in a way that Immelt didn’t. We won’t know, but what I would say, is without knowing exactly how Welch would’ve navigated the 2000s, it’s important to note that some things that were fully out of his control changed right around him, notably, Sarbanes-Oxley, and it was right after he handed the reins to Immelt, that all of a sudden you have Enron, WorldCom, and Tyco.

The result of that is investors, analysts, and regulators taking a much, much closer look at exactly what’s going on inside these big, complex companies, especially ones with big, complex financial operations. Immelt talks about the fact that after Sarbanes-Oxley, all of a sudden, there’s a whole lot more scrutiny. It became much harder for GE to do that earning smoothing that it was so famous for and that plenty of executives acknowledged that they did during Welch’s heyday. (Plenty of people pointed this out – Bill Gross goes off and essentially questions GE’s trustworthiness.) But in 2009, GE settled with the SEC over sweeping accounting fraud charges, for the years just after Welch retired and they made clear that under the scrutiny of serious contemporary financial diligence and regulation, [its financial arm] GE Capital just couldn’t hold up.

When you explore the financialization of corporate America, it almost seems a bit bizarre being like, “Well, what are these companies even existing for anymore?” It seems so far away from a company’s purpose. Was that also an inevitability, or is this only an extreme extension of a philosophy?

Well, I think you used such an important word there, which is “purpose.” This is a book about a man, but it’s really a book about a system. And to me, the system has changed, because the way executives think about the purpose of a corporation has changed and if we take it back to the “golden age of capitalism” or whatever you want to call it, and compare it to potentially whatever we’re getting closer to now with the emergent stakeholder capitalism, Robert Wood Johnson and Larry Fink would agree that the purpose of the corporation goes well beyond making a profit.

When executives and we as a society think about the purpose of our corporations as contributing broadly – making quality goods and services, but also paying workers a fair wage, contributing to communities, and taking decent care of the environment and their supply chains – that leads you to one set of outcomes. Understanding the purpose of a corporation to be like a game, where you maximize profits with whatever tools you happen to have, is going to lead you to another set of outcomes.

Leo Strine has always been such an interesting figure to me, because his writings both establish in Delaware law that a corporate board’s decisions must be made to benefit shareholders and that if they’re not doing that, they’re not upholding their responsibility as a corporation, but he has also come out as one of the biggest proponents of stakeholder capitalism. As you’re considering these structural shifts, how are you squaring those elements?

What law? There’s no law that says companies have to maximize short-term shareholder profits.

Well, it’s the responsibility to shareholders in the sense of creating value for them.

Fine, but that definition leaves room for wide interpretation and one of the great cons of the last 40 years has been the perversion of that statement into the belief that the responsibility of CEOs is to maximize short-term shareholder profits, often in the form of return of capital programs, which is garbage. That’s not the law. The law serves as a necessary, but obviously insufficient and extremely vague guardrail, to say companies should not flagrantly destroy value, they can’t be burning money.

And sure, in extreme cases, you might argue that a company could be willfully destroying its value, but when a company is investing in research and development, when a company is paying its workers good wages in an effort to retain them and have a strong, committed, and loyal and stable workforce, I don’t see how that can possibly be interpreted as somehow destroying shareholder value.

Yeah, I guess I teed that one up for you, because that’s essentially where we’re coming at it, too! Something related to all of this is where ESG [environmental, social, and governance investing] is headed. Under Gary Gensler, the SEC is very clearly working to reduce and also police “greenwashing.” The movement has definitely progressed significantly in the last few years. How do you see it tied to everything we’ve been talking about?

Oh, we have a story on the front page today about the backlash against ESG.

It’s begun. Something has shifted in the business world over the last, call it seven to five years. The emergence of stakeholder capitalism or conscious capitalism, the arrival of ESG, CSR [corporate social responsibility], DEI [diversity, equity, and inclusion] – the acronyms that are trying to signal that companies are looking out for more than their bottom line. All of that amounts to a meaningful shift in the posture of big business and I think that will endure. Not because I believe that CEOs are woke and Trojan Horse progressives trying to implement AOC’s worldview on the world through their corporations, but because I think a lot of employees, especially younger employees, actually expect their companies to stand up for causes they believe in and to represent their values.

Now, that’s not going to mean every company takes the same position. And big companies especially, there’s going to be a vast diversity of views inside, and that’s where you get to these tricky damned if you do, damned if you don’t situations for CEOs. But beyond the most extreme culture war flashpoints that many CEOs have to deal with, the enduring parts of stakeholder capitalism and ESG I believe are going to be some of the things I’ve been talking about throughout this conversation, which is a recognition that corporations need to take better care of workers than they have been on the balance for the last 40 years. That means in practice paying marginally better wages, improving benefits, and increasing the amount of upskilling that’s available. You already see many companies doing this, because they see it’s in their self interest.

It’s a competitive job market all of a sudden, and they need employees who are going to be loyal, engaged, and able to keep up with a changing environment and changing technology. I think it also means, whether or not Republican lawmakers and state treasurers may appreciate it, an enduring commitment to climate action. Hundreds and hundreds of companies have now pledged to go net zero by 2040 and I think thousands have said they’ll do it by 2050. That alone isn’t going to solve the climate crisis, but it signals that executives, corporations, boards, investors, and real institutional capital are recognizing the gravity of the challenge ahead of us when it comes to dealing with climate change. I don’t think even the backlash that we’re starting to see from Republicans right now is going to change that.

To me, there are parallels between this and the rise of shareholder primacy, in the sense that even when Friedman and others first started writing about this in the ‘50s, for example, it was laughed off as extreme or unserious the same way that the birth of ESG and conscious capitalism and all of that could be easily laughed off 20 years ago or so by many people.

Shareholder primacy as an idea then later shaped regulations and politics, and now stakeholder capitalism is in a similar situation now. With shareholder primacy, it went to extremes very quickly. Do you think that there’s maybe a scenario where some of the stakeholder-driven changes could be going maybe too far away from what companies should be focusing on? I often think of when they’re saying, “CEOs, we need to give them a stronger voice in society,” that seems to me, well, we’ve had that before and that’s not always been the best thing for our country!

Plenty of people would argue that we’re already there, and that’s where you see the backlash against “woke” capitalism. I understand the pressure that CEOs are under, to address some of these very contentious social and political debates, but no one elected them as our moral authorities. I don’t want to take my values advice from the CEO of McDonald’s! The whole part of this, of us looking to billionaire executives for sound judgment or a philosophical compass, it’s just laughable and that to me is indicative of what a polarized and unmoored society we live in today, where we don’t have political or religious leaders who could provide that kind of role for us.

But in the same breath, I think it’s important to acknowledge it’s really hard for them to ignore calls from employees, and customers in some cases, to get out there on these issues.

You made the point about how it was a long journey, to get from Keynesianism to the world where Jeff Bezos, Elon Musk, and Mark Zuckerberg control some ungodly amount of the wealth in this country, and the way I think about it is, it was a pendulum that swung over a long arc and I feel like we’re right at that moment where the pendulum is at that moment of pause, right before it comes back.

And if that is where we are, I’d be heartened, because it would suggest that maybe some of the worst excesses of corporations might be over, in some broad way, for the time being. But I can’t lose sight of the fact that if that’s the case, it’s also going to be a long journey to go back in the other direction. I think you rightly said that it happened gradually and then suddenly, when we were moving in the direction of shareholder primacy. I think it’s going to happen gradually with much resistance to the other direction, because listen, there’s enormous, entrenched economic interests that aren’t going to want some of the reforms we’re seeing. Republicans don’t want this to happen, so they’re going to lobby to quash it.

At the end of the book, you point to companies and actions that are heading in that new direction. One of your suggestions is getting worker representation on boards, and of all the suggestions in there, that to me seems the one that would have the most resistance to it in America. Do you actually see any movement there or is that more of a wishlist?

That is my wishlist in that part of the book, but listen, there are real policy proposals from elected Democratic representatives at the national level who are pursuing that and, as I point out, this is not a pipe dream. This literally happens today across the pond in Germany, at most major companies and in fact, it did happen here in the United States, when the head of the United Auto Workers was on the Chrysler board, even when Lee Iacocca was the CEO.

This is almost the most important thing for me: These are choices. We as a society get to choose how we run our economy, and it’s big and it’s messy and it’s a lot of people making different choices, but in the same way that there is no law that says you must maximize short-term shareholder profits, there is no law that says workers and employees don’t get a say in how the companies they work for are run.

I’m just encouraging people to have some imagination as we think about what we want the next 50 years of our economy to look like, especially as we take a real hard look at what the last 50 years have been like.