Investors Are Turning Their Focus to Human Capital. But How Hard Is It to Find and Interpret Data?

Year over year, JUST Capital’s polling of the public shows that Americans are looking to companies to put their workers first. And, today, the country’s labor market is seeing the effects of their frustration at how employers have responded to this. The Great Resignation is wearing on, with workers quitting at rates that continue to break records. At the same time, companies are staring down proxy season with shareholders setting out voting priorities that put extra emphasis on the “S” in ESG.

It’s not just the public and investors that are looking for greater transparency from companies on how they treat their workers. The SEC has noted that standardizing disclosure of human capital metrics – workforce-related data, policies, and practices – is a key area of focus alongside other ESG topics. Chair Gary Gensler recently confirmed that the SEC is working out the details of mandatory disclosure standards on climate, and human capital standards are expected to follow in the coming months. JUST analysis has shown that the current state of human capital disclosure among the 100 largest U.S. employers is minimal – not a single metric we’ve tracked is reported by a majority of companies.

As investors push for more data and the SEC considers imposing new requirements, the bulk of companies will have their work cut out for them to accelerate reporting.

A new survey from JUST Capital, conducted in partnership with SRSS, Ceres, and Public Citizen, also found that the American public overwhelmingly supports greater disclosure from companies and federal standards. Of Americans polled, an average of 87% support the federal government requiring corporate disclosure on human capital and environmental impact data. JUST Chief Strategy Officer Alison Omens discussed the broad support for these standards across demographics on CNBC’s Squawk Box.

At JUST Capital, we’ve been tracking both if and how Russell 1000 companies have been reporting human capital performance metrics, releasing a report on the state of disclosure in October 2021. Our analysis sought to help define what “S” actions are for companies and, in turn, what disclosure should include. It also highlighted the challenges that, in the absence of standards, the current methods of disclosure present for shareholders and others interested in this data.

Companies often use different terminology to represent identical human capital metrics, report on aggregated or disaggregated versions of metrics, and place disclosure on these issues in different sources. To provide a clearer picture of how this affects investors and other stakeholders interested in human capital, we analyzed the data collection time behind our report and what it means for the wider debate on disclosure standards.

How long does it take to collect publicly available human capital data?

Between July and August 2021, JUST analyzed the 100 largest U.S. employers on how they disclose 28 metrics across six key human capital themes: Employment and Labor Type; Job Stability; Wages, Compensation, and Benefits; Workforce Diversity, Equity, and Inclusion; Occupational Health and Safety; and Training and Education. From this analysis, we discovered that:

- Disclosure is low across the board, with the disclosure rate below 20% for the majority of metrics.

- Most metrics are currently disclosed in Corporate Social Responsibility or Sustainability Reports, which do not require auditing or have standardization requirements.

- Metrics that have highest levels of disclosure are most likely to be reported in Annual Reports (10-K Filings) required of publicly traded companies by the SEC.

JUST collected all data for this analysis manually. In other words, our team read through various publicly available company sources and recorded the information exactly as it was disclosed by companies, noting details about the link, source type, date, calculation methods, and other important metadata to better understand the context of disclosure.

Each year, JUST Capital spends over 5,250 hours collecting over 200 data points for our annual Rankings of America’s Most JUST Companies. It takes a team of between 20 and 30 analysts and interns, wading through different public corporate reports and disclosures, to find data for the over 950 companies we rank from the Russell 1000 index.

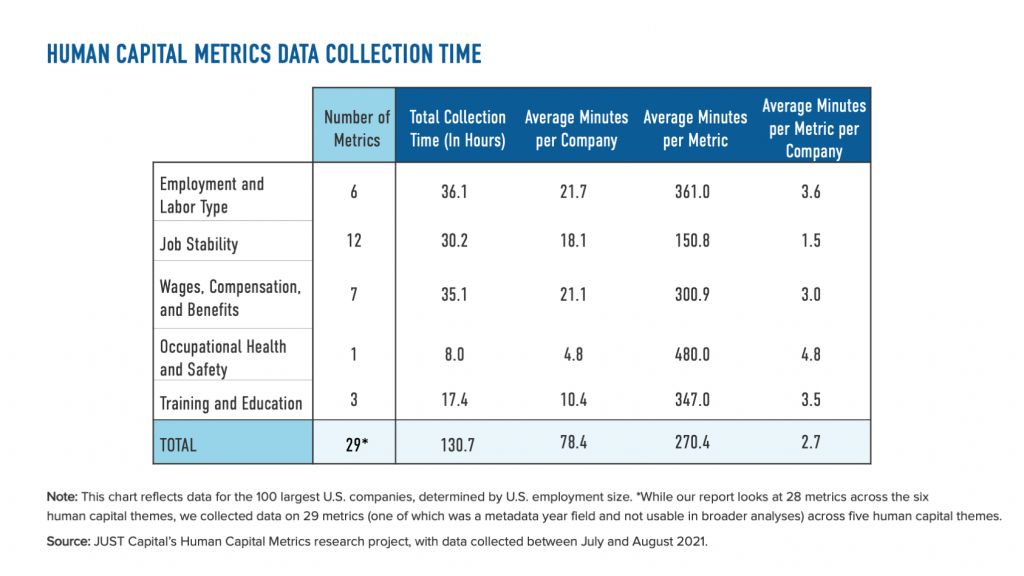

By comparison, we found that it took a team of two over 130 hours to collect data for 100 companies on the 28 human capital metrics featured in JUST Capital’s report. The figure below breaks down this time by theme. Likely due to the number of metrics included in the Employment and Labor Type; Job Stability; and Wages, Compensation, and Benefits themes, they took the most time to collect at 36, 30, and 35 hours, respectively. It’s important to note nonetheless that these numbers show how challenging it is to find and aggregate data on ESG metrics overall.

To get a better sense of how long it takes to collect this data while accounting for the difference in the number of metrics within each theme, we looked at the average minutes of collection time per metric per company. Interestingly, while metrics in the Job Stability theme took some of the longest total time to collect, the time we spent per metric per company is in fact the lowest at just above a minute and a half. In contrast, the theme with the shortest overall collection time – Occupational Health and Safety – yielded the longest collection time per metric per company at almost five minutes on average despite the fact it only included one metric for collection.

At first glance, the average time to collect any one metric for a single company may appear relatively small and the difference in time across themes insignificant. However, the cumulative effect of collection time variability becomes noticeable when collecting data for 100 companies – and even more so if we were to expand data collection to the full Russell 1000.

Does human capital data collection time vary by source type?

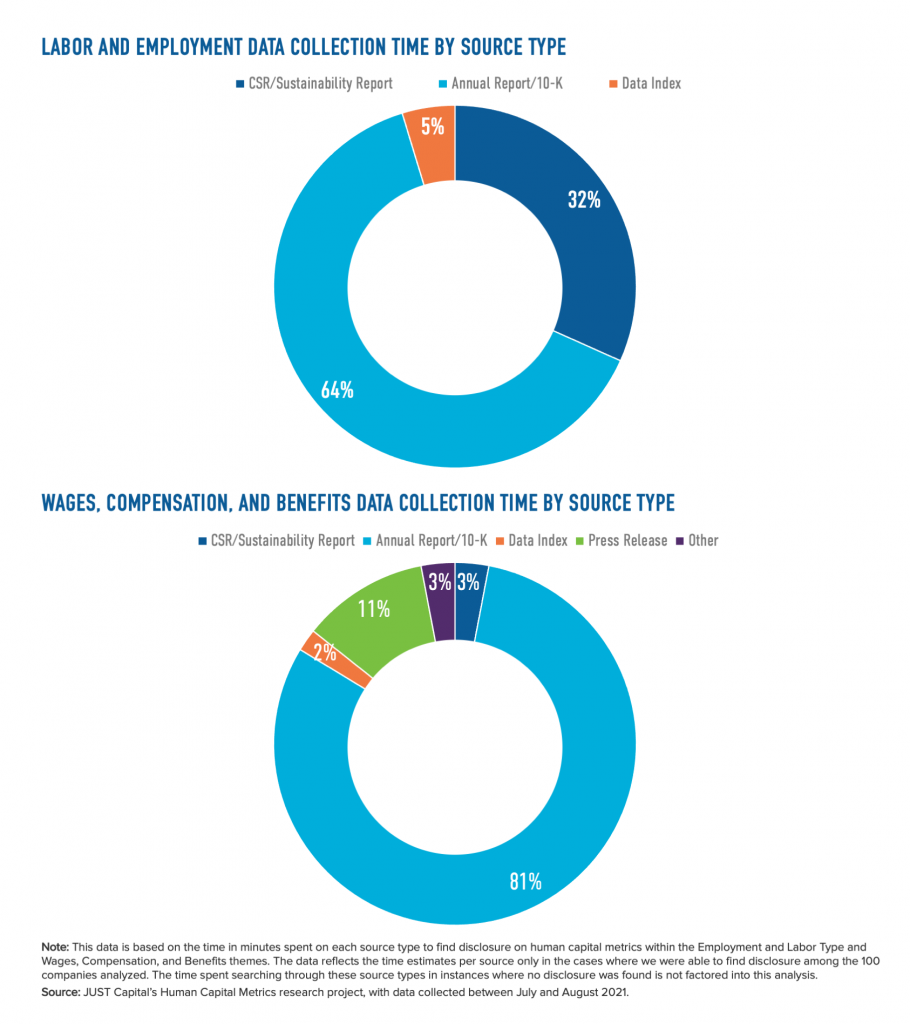

To answer this question, we looked at the two themes with the highest overall data collection time: Employment and Labor Type (36 hours); and Wages, Compensation, and Benefits (35 hours). Analyzing the collection time per source type for these themes revealed an interesting finding: annual reports and 10-K Filings are the most time-consuming source type. In instances where companies disclosed data on these themes, our analysts spent 64% and 81% of their time, respectively, locating it through Annual Reports and 10-K Filings.

While Annual Reports and 10-K Filings tend to number at over 100 pages (including technical language, tables, and footnotes), the absence of standardization remains a key factor in making finding human capital data in this source time consuming for investors, researchers, and other stakeholders.

It is important to note that the longer length of the time spent on 10-K Filings may have been unintentionally affected by our data collection approach as well. We knew from previous experience with data collection that human capital data was rarely found in the 10-K, meaning that Annual Reports and 10-K Filings were not always the first source that we referenced. Instead, we typically looked at CSR and similar reports first because, from our previous data collection experience, companies are more likely to disclose human capital metrics there.

How does non-disclosure affect human capital data collection time?

Due to the nature of manual data collection it is also possible that some data gets overlooked, especially when it is concealed in company sources that may not be easily accessible. To reduce the risk of omission, JUST Capital carries out a thorough review of companies’ publicly available materials and employs different search methods to ensure that information is in fact not available. Such a meticulous approach, however, is time consuming. This was certainly the case with human capital metric data collection, as JUST Capital’s research found exceptionally low disclosure across the board. In fact, the majority of the time that our analysts spent searching through company resources resulted in finding no disclosure.

For instance, we spent approximately 53% of data collection time (19 hours) looking for data on the Employment and Labor Type metrics without finding any disclosure. Similarly, we spent over 83% of data collection time (29 hours) going through company sources without finding a single disclosure on any metric under the Wages, Compensation, and Benefits theme. While finding human capital data is a long process, not finding it, and ensuring that it is in fact not public, takes significantly longer.

The length of time that human capital data collection requires serves as a proxy to how complicated it is to find this information. Disclosing data is only the first step toward increased understanding of how companies are performing on various human capital metrics – and, on its own, it’s not enough. The next step is adopting standardized disclosure practices that ensure the data is easily accessible and unambiguous.

This is the crux of the current debates on human capital and broader ESG disclosure. The exploration of data accessibility, comparability, and, finally, performance are the key questions policymakers, investors, and others are asking. While these questions shape standards, in the meantime, corporate leaders will need to take the first step of disclosure.