2022 Is the Year to Finally Define, Align, and Drive Action on the ‘S’ of ESG

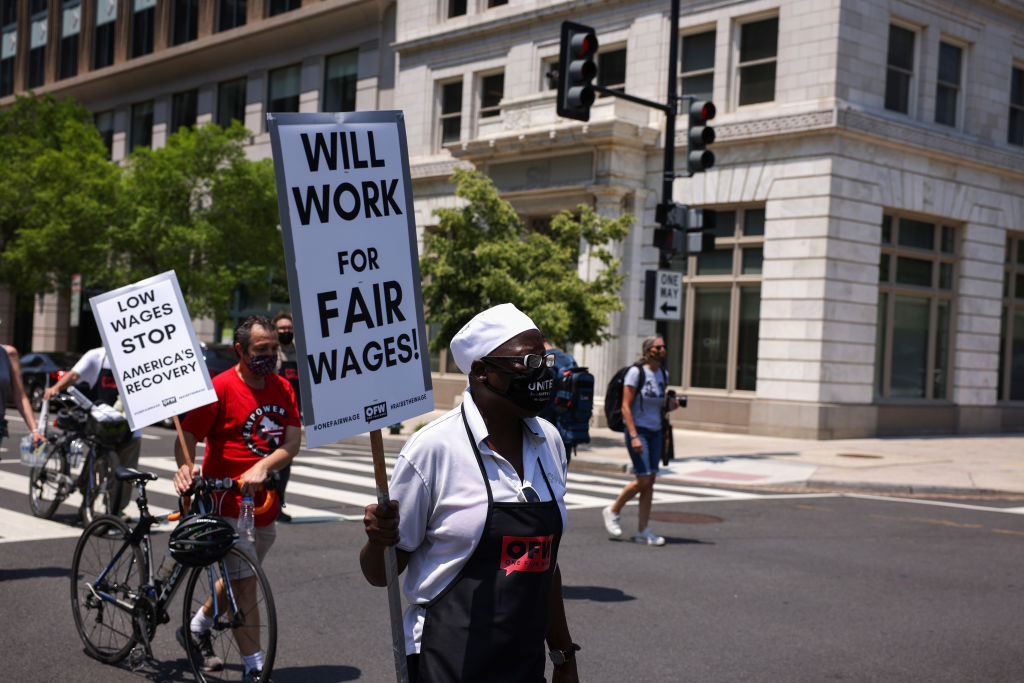

Nearly two years into the COVID-19 pandemic, the U.S. workforce is once again squarely in the spotlight. And it’s not just that the Great Resignation is wearing on, with the Department of Labor this week reporting 10.9 million jobs were open in December 2021. Major signals from various parts of the market are showing companies and investors are paying attention to this in a new and important way. Asset managers like State Street, Vanguard, and BlackRock have all issued 2022 proxy voting guidelines that emphasize that they’re looking at the materiality of good jobs.

There is clearly a recognition across sectors that an investment in workers is, at the very least, worth considering as a business strategy, and in many cases, an increased acknowledgement that they represent untapped value to business and to society. The macro trends have also translated to a heightened focus on the “S” (Social) factors in ESG, and better definitions around it.

What’s the business imperative that markets need to focus on today?

- Define the “S” and what an investment in workers should include.

- Encourage companies to shift practices to make those investments.

- Ensure capital – ESG inflows – drive meaningful outcomes that support workers and drive a more virtuous cycle of returns.

Interestingly, the current momentum is behind the first, around defining what to measure, and mostly lagging on the latter two.

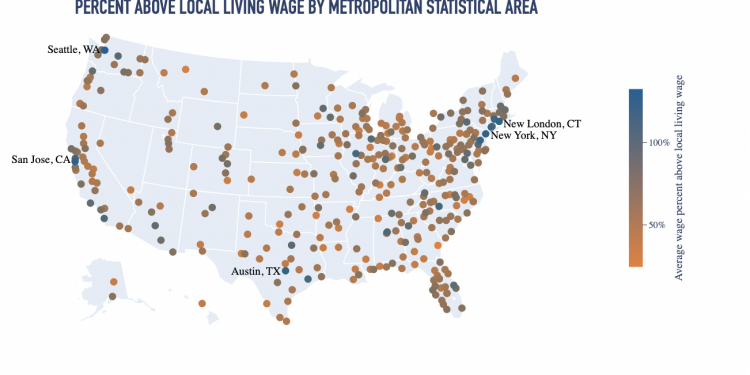

So first, defining what Social factors matter most is important. And certainly workers’ basic financial security, opportunities for mobility and advancement, and workplace equity are critical elements. Unfortunately, corporate disclosure on these “S” issues tend to be negligible, token, or nonexistent, as JUST analysis has shown. The Social factors are also unstandardized, making it challenging to meaningfully benchmark and compare company performance. While this may soon change, as the SEC has signaled it is considering new human capital standards, choosing to not disclose at all sends a message to stakeholders, and leaves companies falling back on inadequate benchmarks and behaviors.

But it also feels like nonprofits, philanthropists, government, and the private sector are spending too much time defining the “S” at the expense of action. Now is the moment to shift momentum towards incentivizing companies to invest in workers and ensuring ESG inflows are driving connected outcomes.

For JUST, 2022 is the year to not only define but align and drive action on the “S” of ESG. That means inspiring higher levels of transparency and disclosure by companies on key metrics, and using the power of data, storytelling, and markets to accelerate action. If we don’t connect capital going toward ESG inflows to “S” outcomes, our collective work runs the risk of being merely the new “green-” or “purpose washing.” With new human capital data in hand, companies, employees, investors, and other stakeholders will have a more holistic and accurate benchmark for how to align operations with worker issues. In other words, it’s time to ensure meaningful change is attached to ESG.

To power this transition, we’re expanding our corporate action team, bringing in new nonprofit partners to help us pull in the same direction, and utilizing new platforms like our partnership with CNBC to shine a light on research insights, data benchmarks, and corporate performance to drive impact. We’re excited about where we’re headed and hope you’ll join us as a corporate leader, ESG partner, or supporter on this journey.