What Effect Would Tax Reform Have on America’s Bottom Line?

President Trump has taken his first steps toward reforming our troubled tax system, unveiling a one-page outline that has garnered both skepticism and praise in varying measures from legislators, journalists, and pretty much everyone else. The plan prompts more questions than it provides answers, as it proposes to eliminate the carried interest loophole, double the standard personal deduction, and cut the corporate tax rate by more than half. While the stated goal is to create jobs and spur economic growth, many are dubious as to how and whether this plan will actually accomplish this.

At JUST Capital, we know that the American people feel strongly that big corporations should “pay their fair share of taxes.” We are still exploring the nuances of what that means, however, we think it’s safe to say that the public is not enamored with highly profitable corporations going out of their way to make little or no contributions to the domestic tax base. And this holds true even if it legal for them to do so and especially if they are wildly profitable. It’s no secret that our tax system already allows corporations to pay well below the official federal corporate tax rate (one of the world’s highest, at 35%). Under President Trump’s tax plan, the corporate tax rate would drop to 15%, less than half the current rate. It’s worth asking the question, therefore, what could the new corporate tax regime actually look like for the US Treasury? And how might it square with the interests of ordinary hard-working Americans?

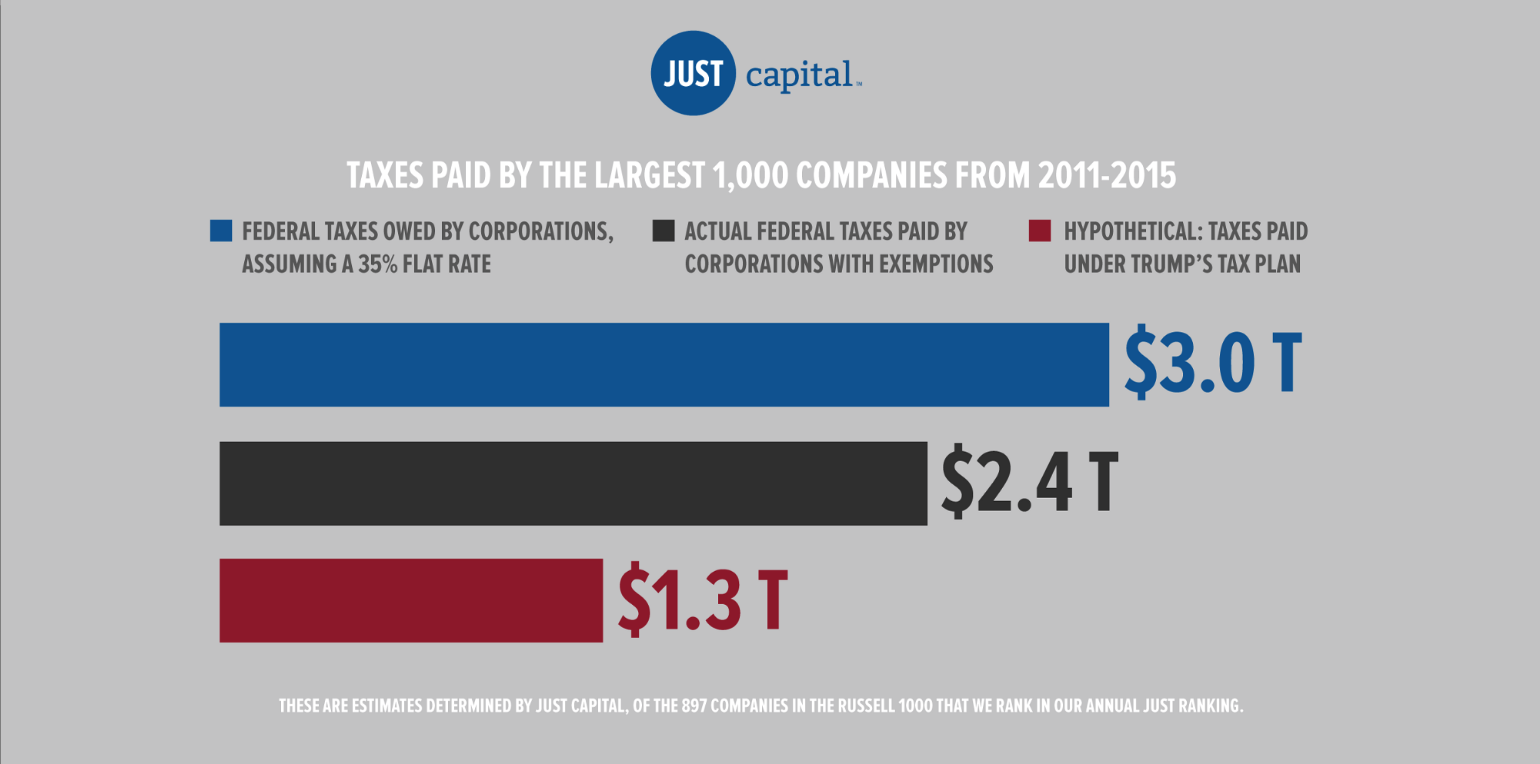

Our research team took a look at how much the Russell 1000 have been paying in taxes, compared with what they would have paid at the full 35% rate. We found that between 2011 and 2015, the average Federal tax rate for this group of companies was actually 24%, accruing $2.4 trillion in total income for the US government. If they’d paid the full 35%, the total would have been $3 trillion. The $600 billion difference would have covered the combined budgets of the Departments of Education and Environment combined over the same period. Under the proposed 15% scenario, the total Federal taxes accrued would be just $1.3 trillion, about half of what they did pay, and about a third of a loophole-free rate.

The Trump Administration is sticking to the well-established if somewhat discredited trickle-down economic theory that these tax cuts will stimulate economic growth, allowing corporations to create new jobs and presumably pay higher wages with their rapidly-growing profits. In terms of what our polling indicates Americans want, there’s nothing inherently wrong-headed about this. Indeed, our nationwide surveys found that people of all demographic backgrounds, locations, and economic brackets repeatedly prioritize new jobs and higher wages over fair corporate tax payments. That said, with public trust in institutions plumbing new depths, there is a real risk of popular backlash if the jobs and higher wages don’t materialize. Or worse still, if corporations celebrate their lower tax windfalls by returning even more profit to their shareholders rather than reinvesting in their businesses or raising wages.

Doing your bit. Pulling your weight. Paying your fair share. In one sense these are acts of moral responsibility. That’s not to say we want to (or should) pay higher taxes; rather, it’s a recognition that there is a line in the sand beyond which behavior is simply not, well, just. America’s corporate leaders may find that corporate tax reform presents them with yet another moral balancing act.