The Data Suggests ESG Is Not a Cause of Inflation

The rise of ESG (environmental, social, and governance) investing in the United States has been rapid. Recently, it has also become a divisive political issue. Some critics, such as the The State Financial Officers Foundation, have gone so far as to label ESG a contributor to the elevated inflation lingering in the country. Given that some of the underlying factors typically covered by ESG investing often relate to the themes and issues we cover in our own Rankings, we thought we’d take a closer look at this, and see what the data has to say.

The ESG-inflation argument is weak

Annual inflation has cooled from the four-decade high seen last summer, but recent data shows it remains higher than many had expected. As a result, the Federal Reserve may raise interest rates even higher in the months ahead to make sure inflation declines further until it reaches its long-term 2% target.

But even as inflation declines, it still remains a singular source of stress on family budgets for essentials like grocery staples, commuting, and energy services. Indeed, polling shows Americans believe inflation is the number-one issue facing the country today. Large numbers of Americans are currently struggling with economic hardship, especially as inflation reduces wages’ purchasing power, and indeed real wages have, on average, declined over the past year.

The literature suggests there are four main causes of the current inflation: First, supply side causes due to the COVID-19 pandemic, Russia’s invasion of Ukraine, and China’s zero COVID policy which strained supply chains and restricted the supply of many goods. Responding to the pandemic, public officials then, on the monetary side, expanded the money supply (the second cause) and also, on the fiscal side, increased government spending (the third cause), fueling demand. Finally, as demand rose, companies were able to regularly raise prices which concomitantly drove higher profits.

Though there are ongoing academic and policy debates about the relative influence of these causes and the degree to which they feed into each other, there is precious little economic evidence to suggest that corporate and investor-led ESG strategies have been a major factor driving inflation at this point in time.

Of course, one main challenge in evaluating the connection between ESG and inflation is that different people define ESG in different ways. Much of the argument that ESG contributes to inflation is centered on the energy complex, the opposition to fossil fuel production and usage, and increased gas prices. Although there are real debates about the relationship between ESG, energy supply, and commodity prices, there is little clear evidence to suggest that ESG strategies by companies and investors pushed gas and crude oil prices higher in 2022. Indeed, executives of major oil and gas firms have themselves stated that ESG is not one of the main reasons wearing on oil and gas production growth.

To deal with inflation, investors and companies should prioritize stakeholder-focused leadership

As regular JUST followers know, our approach centers not on an ESG approach but rather a stakeholder-oriented approach in which the factors that matter are identified and prioritized by the American people. Nevertheless, given the above, we thought it would be interesting to examine the connections between our own company Rankings and indexes, and inflation.

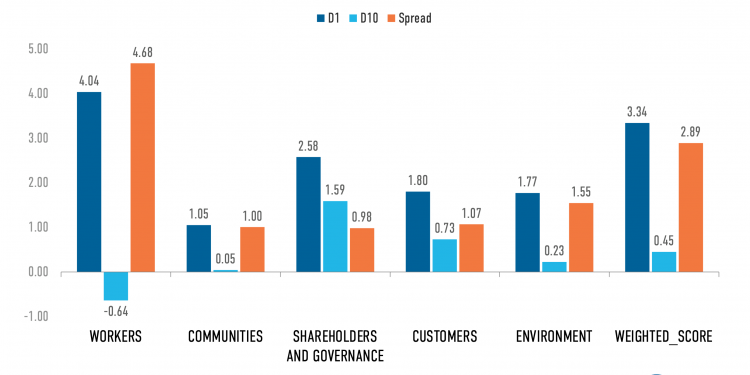

What we found is that as inflation further exacerbates nominal declines in equities and indexes, investors can turn to JUST Capital’s approach to identifying corporate stakeholder leadership to shield their portfolios’ real returns. Just companies tend to outperform their peers, and in fact JUST Capital’s U.S. Large Cap Diversified Index (JULCD) and JUST 100 Total Returns Index (JUONETR) have both outperformed their benchmarks since their inception (respectively by 9.4% and 13.3% as of December 31, 2022).

Companies, meanwhile, can unlock value by enacting human capital policies to increase employee satisfaction, retention, productivity, and ultimately performance. Productivity, whereby the same unit of input yields additional output, is key. Though inflation squeezes margins, especially through cost pressures, companies can maintain or even increase their profitability by increasing productivity.

Research has shown that higher wages for low-income workers result in higher productivity, and JUST Capital survey research found that the American public overwhelmingly agrees (87%) that companies should regularly increase wages to keep up with the rapidly rising cost of living. Companies can hedge against inflation by increasing productivity not only by raising employee wages, but also by investing in benefits packages, career advancement, worker health and safety, and flexibility.

As investors and companies face the economic uncertainties of 2023, one strategy that can help protect margins and outflank the challenge of inflation is to turn to JUST Capital’s stakeholder-focused approach based on the priorities of the American public. Our research suggests that it is a win-win for not only investors and companies, but also for the American public in general.