The JUST 100 Methodology: How The Rankings Work

Today JUST Capital and Forbes are publishing the inaugural JUST 100 rankings which names and celebrates the publicly-traded companies in America that perform best on the things Americans care most about. The concept is simple – by shining a light on how big corporations behave on the issues that matter to us, we can help to incentivize more just business behavior and focus the markets on solving the intractable social, economic, and environmental challenges of our time.

Here’s how we do it. The 2016 rankings detail the performance, on an industry-relative basis, of the largest 897 publicly-traded companies in the U.S.. In the future, we will expand our coverage of companies (including geographically), and broaden the range of rankings produced. To define what just corporate behavior actually means, JUST Capital has so far polled over 50,000 members of the American public, with a continuous, multiphase series of surveys. Our survey partner for 2016 was the National Opinion Research Center (NORC), based at the University of Chicago, and we used what’s called a Maximum Difference (‘Max Diff’) approach. Basically, this means we ask respondents this kind of simple choice question over and over again, which builds up a picture of relative importance:

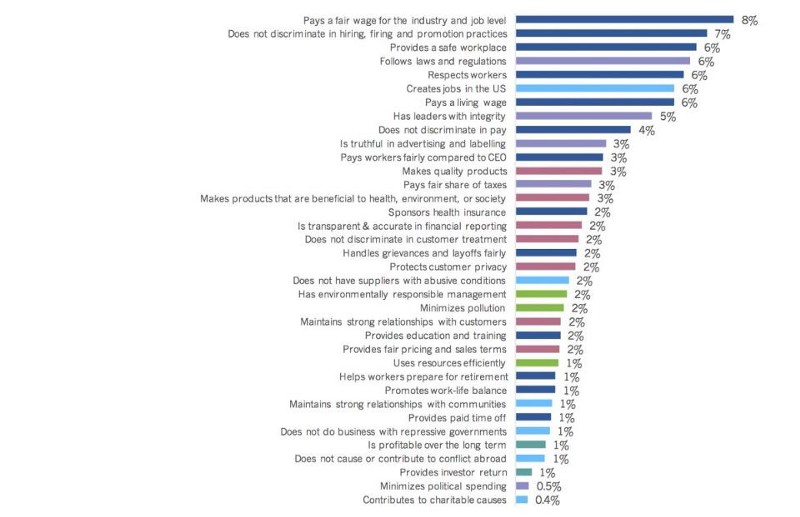

These polls, which target a representative sample of the U.S. population, determine the specific elements of corporate justness, and their relative importance. We call them Components. In total there are 36 Components, which for ease of communication we group into 10 Drivers. Each has a different weight, and the total adds up to 100%. These cover everything from worker pay and worker treatment, to leadership and ethics, job creation, customer treatment, supply chains and environmental performance.

We establish Metrics for each of these 36 Components and collect and evaluate data on them from an extensive range of sources, using an array of different technologies in order to measure corporate performance. Along the way, we have transparent and clear protocols for handling things like missing data, time-series data versus one-off data points, outlier events, and so on.

To produce the actual rankings, we calculate a series of individual numerical scores at the component level. These scores are calculated and normalized across metrics. A company’s overall score on justness is then determined by calculating the weighted sum of its scores across all 36 Components. We rank companies within their respective industries based on the Global Industry Classification Standard, or GICS, created by MSCI and Standard & Poor’s.

Finally, it’s worth noting that we are committed to continual improvement, neutrality and transparency. We have a sizable group of expert advisors and use independent third party consultation where possible to the review process, the public survey and polling research, and the corporate performance analysis. We are constantly looking for input and guidance on how we can do things better. The entire scoring methodology is posted on the JUST Capital website, and we welcome feedback and suggestions from anyone, at any time.

No doubt the methodology will improve over time, but for now we think it represents a ‘best in class’ approach that will stand up to scrutiny.