50 Years After the Introduction of the ‘Friedman Doctrine,’ It’s Time to Create a New Capitalism

When the New York Times Magazine published Milton Friedman’s essay, “The Social Responsibility of Business Is to Increase Its Profits,” 50 years ago, Friedman was six years shy of his Nobel Prize win and not quite yet on the path to becoming one of the world’s most influential economists of the 20th century. And while his various ideas had growing clout in libertarian circles, his “Friedman Doctrine,” as the Times dubbed his theory about the role of corporations, still had an air of being radical for its time.

Friedman had been an advisor to Republican presidential candidate Barry Goldwater, whose conservative ideology resulted in massive defeat in 1964 but two terms for Ronald Reagan in the ’80s; Friedman’s book “Capitalism and Freedom” (one of its chapters is the basis for the Times essay) was a flop when it was first published in ’62, but was a bestseller by the time he was advising Reagan here in the US and Prime Minister Margaret Thatcher in the UK.

There are many reasons for this transition, but as for the idea of shareholder primacy laid out plainly in the Friedman Doctrine, it grew in appeal in the ’70s as corporate profits declined and America’s trade deficit grew. Put simply, the role of a corporation that Friedman had been pushing for years was about to have its time. It’s a time that we’ve been living in for the past four decades, and one that we at JUST Capital think has lasted long enough.

Average wages have stagnated, and the level of wealth and income inequality has persisted at pre-Great Depression levels. The financial crisis of ’07-’08 awakened the majority of the country to this destabilization of our economy and society, and the pandemic has been another cruel reminder. Six years of polling the American public, including COVID-era surveys done in partnership with The Harris Poll, have shown that Americans want business leaders to play a role in tying their corporate purpose to society rather than profits at all costs, and an increasing chorus of executives, academics, and politicians are agreeing.

As we look back at the capitalism of the past 50 years, we’re considering where it needs to head to make stakeholder capitalism, the alternative, a reality. We’ve collected insights from prominent supporters for an idea of what that can look like.

Companies must recognize they do not exist in a bubble, and that social and natural capital are not ‘free’

In her book “Reimagining Capitalism in a World on Fire,” Harvard Business School professor Rebecca Henderson argued that the reign of shareholder primacy led corporations to treat social capital, like workers’ livelihoods, and natural capital, like the health of the environment, as “free.” Now, she wrote, as executives consider the risks posed by a climate crisis and inequality-fueled populism, they’re starting to realize that these resources are, in fact, expensive.

Both are leading more companies to recognize that they have a responsibility to the health of a society, and can’t have the extent of that be lobbying for policies that will benefit their industries.

Henderson sent JUST the following:

The most critical action we can take to “fix the system” is to change the rules. I’m a huge fan of capitalism at its best, and I think that free markets are one of the great inventions of the human race – but they only work their magic when markets are genuinely free and genuinely fair. For that to happen, prices have to reflect real costs, and at the moment, our failure to price in the harm from greenhouse gas emissions is causing immense distortions. We also know that vast disparities in education and healthcare – often in combination with continued discrimination against people of color – has meant that many people don’t have the opportunity to participate in the free market in a way that could reach their full potential.

We need to rebalance capitalism. We must remember that free markets must be balanced by democratically accountable, transparent governments and strong civil societies, if we are to build a just and sustainable future. Business must step up to make this possible. Our economies, and with it our firms, will suffer enormously if we don’t address the problems that we face. Working them is already opening up billion dollar opportunities across the economy.

The purpose of business is not maximizing shareholder value – that was only ever a means to an end. The purpose of business is to build a thriving and prosperous society. And right now, that requires taking a wider view.

Companies must balance the long-term with the short-term

Perhaps the economist most directly opposed to Friedman’s ideas on markets is fellow Nobel laureate Joe Stiglitz, of Columbia. Before I joined JUST, I interviewed Stiglitz in depth on the topic. The two knew each other, and had long debates.

Friedman believed that the “invisible hand” of market forces, as applied to competitive industries, would allow companies fixated on maximizing profit to in turn benefit all stakeholders. That is, prioritizing short-term gains leads to optimized management and capital allocation, which in turn allows the company to grow and make higher returns, when then in turn leads to more jobs, better products, and other benefits to society.

Stiglitz told me at the time that it was a rejection of the Keynesian system that had become the norm by the time Friedman was writing – and John Maynard Keynes himself noted in 1936 that the American stock market encouraged the pursuit of short-term gains benefitting investors at the expense of long-term ones benefitting society. The debate going on today is not a new one, the world has just drastically changed around it.

Stiglitz argued that Friedman’s belief “was not based on any economic theory.” Stiglitz and the economist Sandy Grossman published a paper in 1980 that stated that while market equilibrium that the invisible hand was always guiding us toward could exist in theory, it could not in reality – meaning Friedman’s theory would fall apart.

Stiglitz wrote in his 2015 book “Rewriting the Rules of the American Economy” that the Friedman Doctrine became entrenched in American business through deregulation, lower taxes, and relaxed antitrust laws, which created a climate fostering activist investors.

He wrote: “If all of this had led to more efficient and innovative corporations, that would have been one thing. But in fact, the new ‘activist’ investors pushed for seats on boards and pressured management into policies that were viewed as more ‘shareholder-friendly’ — meaning friendlier to short-term investors — including increasing dividends and buyouts.”

Proponents of Friedman’s approach will say that the way CEO pay increasingly became tied to stock performance during this time keeps CEOs accountable to their shareholders. As Stiglitz argued, it instead is “an incentive to manipulate stock prices by using company money to buy back shares in order to drive prices higher.” Stepping back, the average ratio of CEO-to-median-level-employee pay from 20-to-1 in 1965 to 295-to-1 in 2018.

BlackRock CEO Larry Fink, head of the world’s largest asset manager, helped take the pushback against the prevailing system into the business mainstream when he wrote in his annual letter to CEOs a couple years ago that his firm would only do business with companies that clearly defined their long-term business strategy and connected it to social benefits.

Fink wrote: “Without a sense of purpose, no company, either public or private, can achieve its full potential. It will ultimately lose the license to operate from key stakeholders. It will succumb to short-term pressures to distribute earnings, and, in the process, sacrifice investments in employee development, innovation, and capital expenditures that are necessary for long-term growth. It will remain exposed to activist campaigns that articulate a clearer goal, even if that goal serves only the shortest and narrowest of objectives.”

Structural change is necessary to enable stakeholder capitalism

It’s critical to note that when we talk about stakeholder capitalism, we’re not talking about merely a change in rhetoric. We will need to rethink how we measure value creation if proclamations like the Business Roundtable’s revised purpose of a corporation are to mean anything substantial.

Columbia Journalism professor Nicholas Lemann (disclosure: he was dean when I attended) tracked the evolution of American capitalism over the past century in his book “Transaction Man,” which provides valuable context for today’s debate. In a comment shared with JUST, Lemann wrote that while shifts in public opinion can create an environment for change to our economic system, reforms to capitalism have always come from structural change. He wrote:

Milton Friedman may have stated the basic premise of the shareholder revolution first, but in many ways the revolution’s most important founding father was Friedman’s younger colleague Michael C. Jensen. “Theory of the Firm,” an academic paper that Jensen, as a young professor at the University of Rochester’s business school, coauthored in 1976, began to suggest a number of techniques that could be used to instantiate Friedman’s idea. Most of these tried to get managers to act like owners, by, for example, making then the actual owners (as in leveraged buyouts and private equity), or by paying them mainly in the form of stock options. Ideas become reality when there are structures to make them do so.

In thinking about the nearly century-old back and forth between stakeholder and shareholder capitalism, we tend to pay too much attention to fuzzy factors like the national ethos and the intentions of managers and shareholders, and too little to structures. The conventional wisdom about stakeholder capitalism in its post-second World War form is that it was produced by the economically secure position of American industrial corporations, and by the benign impulses of the corporate executives of the day. But this was actually a world created by government policies, beginning during the New Deal — policies that made organized labor more powerful, that put corporations under heavy government regulation, and that restrained the power of Wall Street firms. And in the 1970s, a new generation of government policies, most of them deregulating finance in a variety of ways, undergirded the shareholder revolution.

I am skeptical that the new stakeholder revolution, proclaimed last summer in a statement produced by the Business Roundtable, will not amount to much unless government is once again in the picture. It’s unlikely that the statement would have been written if there weren’t already rising and impossible to miss global political animus against big corporations. And corporations can’t practice true stakeholder capitalism unless they are legally freed of their primary fiduciary obligations to their shareholders. Look at politics in 2020, at least in the Democratic Party: you can sense the next wave of policy approaching.

Changes that would be secured in public policy can begin in the private sector. Before COVID became a global pandemic in March, one of the hottest topics in business was the future of ESG (environmental, social, governance) investing and the consolidation of ESG metrics, as “sustainability” can currently be defined at the whim of investment firms or companies themselves.

There has been progress on that front. JUST CEO Martin Whittaker, however, said in a new editorial for Business Insider that this logic must also be applied to business operations. Speaking for the Business Roundtable, GM CEO Mary Barra told Fortune that last year’s statement on purpose “was catching up with reality,” and that the CEOs who signed it had already been balancing the needs of their investors with the needs of their other stakeholders. Whittaker said that while that may be true, if the stakeholder capitalism that an increasing number of corporate leaders are endorsing is ever going to replace shareholder primacy, then total shareholder return as a guiding light is going to have to be replaced with “Total Stakeholder Return.”

Companies will benefit from listening to their stakeholders

Friedman wrote in his Times essay that if CEOs allocated money in ways that did anything aside from maximize profit, they were imposing a tax of sorts on their shareholders and customers. This operates on the assumption that if a CEO were, for example, to decide to take somewhat of a hit in a quarter during a pandemic to provide robust worker benefits, they were cheating their investors and the people who buy their products and services. But it does not take into account the future value of these investments – a healthy, financially secure workforce is a more productive and stable one for the duration of that pandemic – or, as JUST has shown for the past six years, what the public actually wants.

As Whittaker wrote in the editorial mentioned above:

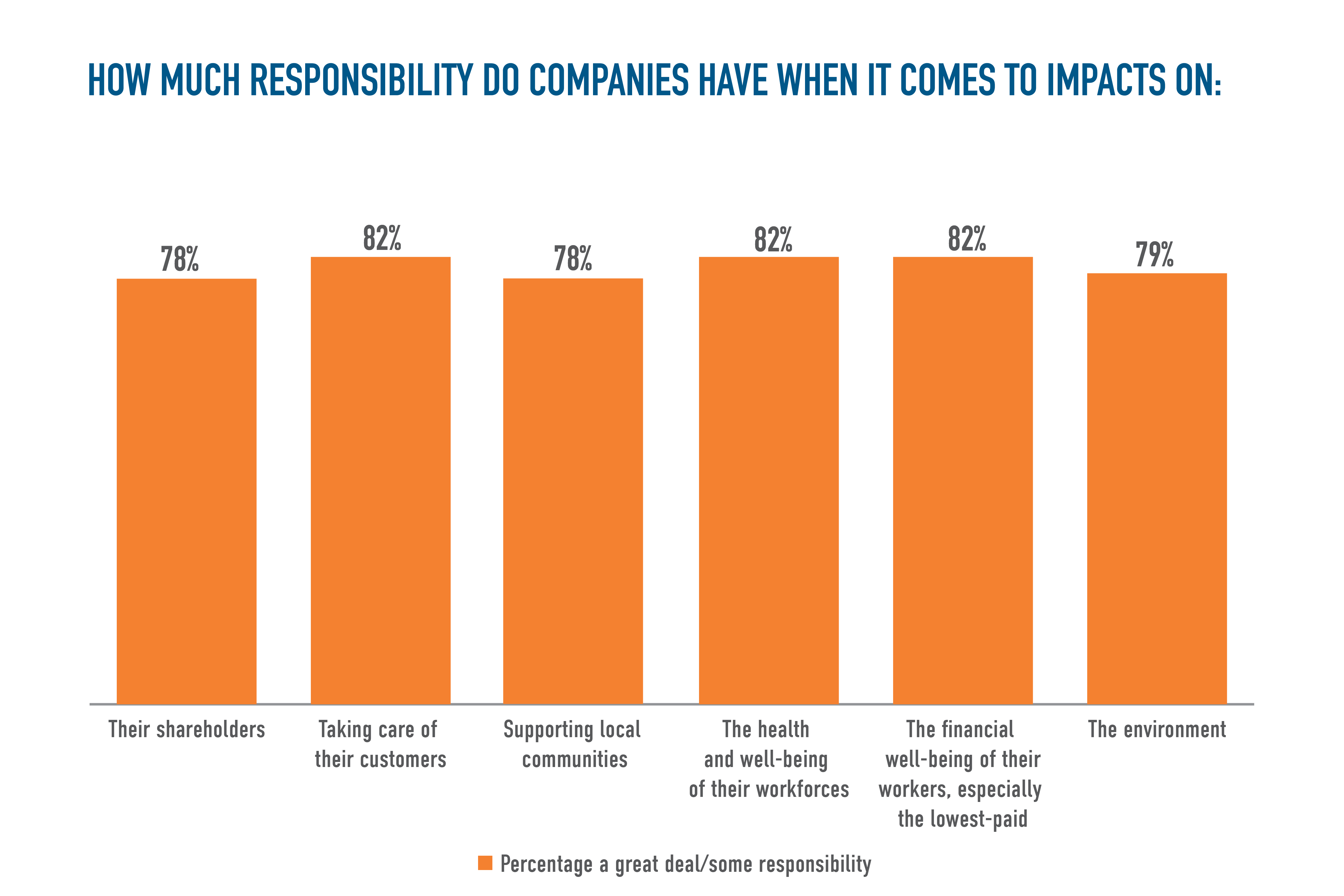

Our polling, done in tandem with The Harris Poll, suggests that a substantial majority of the public — regardless of background, age, location, or political ideology — supports the idea of companies creating value for all their stakeholders. Last year, our survey respondents prioritized key stakeholder issues with the following order of importance: workers (35%), customers (24%), communities (18%), environment (11%), and then shareholders (11%). (Percentages reflect relative prioritization of these stakeholder categories based on representative survey populations.)

To be clear, this does not mean that the stakeholder necessitates sacrificing your company’s financial performance for a perceived moral good, or otherwise cloaking profit maximization beneath a soft, PR-friendly mask; on the contrary, our research suggests companies that lead in meeting the needs of all their stakeholders have outperformed the laggards by almost 30% over the past four years — and by double-digit margins throughout the pandemic. They also have lower risk profiles, decreased market volatility, shallower drawdowns, and greater profitability.

Companies are recognizing this. It was remarkable to see, for example, how many corporations responded to the George Floyd protests against police brutality and racial inequity this summer with significant investments in diversity and inclusion efforts within their own organizations, as well as through sizable charitable donations.

JUST and The Harris Poll found that the large majority of Americans either somewhat favored or strongly favored CEOs responding to the protests with a statement about ending police violence (84%), promoting peaceful protest (84%), elevating diversity and inclusion in the workplace (78%), condemning racial inequity (75%), and condemning police killings of unarmed Black people (73%). It’s important to remember that before this year, most corporations would want to steer clear of such hot topics. But Americans, in their roles as workers, customers, and shareholders, are considering businesses in a way that would be anathema to Friedman.

As Ford Foundation president Darren Walker told CNBC in June, “More is going to be demanded of corporations, and more should be demanded, because they have a tremendous influence on how we live our lives.”

Stakeholder benefits must be tied to purpose, which in turn must be integrated into core business strategy

Friedman was right to point out that many CEOs couching their actions in moral rhetoric were being deceptive – and anyone who follows ESG investing knows all too well about “greenwashing.” If a company was investing in a community it operated in, Friedman argued, it was doing so because it could strengthen their business, not because of a moral imperative.

What’s interesting is that corporate leaders are not contesting Friedman’s point, but rather countering it. For example, JPMorgan Chase has, over the past decade, made significant investments in communities, but embrace rather than hide the way it is benefitting their business. Peter Scher, JPM’s head of corporate responsibility and chair of its mid-Atlantic region, wrote to JUST:

This year has provided a stark reminder of why business must play a proactive and deliberate role in supporting and rebuilding our communities.

With the COVID-19 pandemic exacerbating longstanding economic and racial disparities around the world, it is critical for business to step up and play a major role in creating opportunity and level playing field for dramatically more people. It’s not only the right thing to do, but it’s an economic imperative and good for the future of business. This is the new definition of capitalism. It is no longer just about a company’s short-term bottom line, it now includes businesses responsibility to society – how we support our employees and how we invest in the communities, especially those who have struggled and been underserved for decades. We, as business leaders, must step up to help solve systemic problems, and use our capital and other resources to do so, because that is in the long-term interests of our companies and our shareholders.

JPMorgan Chase is using our business expertise, policy ideas and philanthropic investments to help create an inclusive recovery and racial equity. We’re doing this in four major areas: skills development and careers, financial health, neighborhood development, and small business. And through our JPMorgan Chase PolicyCenter, we are advancing policies that remove barriers to economic opportunity, including second chance opportunities for those who have been part of our criminal justice system.

Detroit’s continued turnaround provides a good example of how business can collaborate with local government and community organizations to help those who have struggled for decades. JPMorgan Chase, along with other companies, have worked closely with Detroit and Michigan’s leaders to provide capital, jobs, training, technology, and a host of other resources to help Black Detroiters and many of the city’s neighborhoods recover and rebuild. We’ve done business in Detroit for 85 years: a long-term investment in its revitalization is not only good for Detroiters, it also makes very good business sense.

Businesses have a collective responsibility to lift up the communities that we serve and invest in the future – for our shareholders, customers, employees, and communities. When our communities thrive, we all thrive.

It’s easy to see how the same logic applies across the board.

For workers, Zeynep Ton, president of the Good Jobs Institute, has shown in her work how neglecting workforce investments for the sake of cost-cutting and profit-maximization has resulted in “bad jobs” that destabilize a business. Employees that are trusted with “good jobs” and rewarded fairly are more motivated and productive, which results in a better customer experience and, in time, better shareholder returns.

It also makes sense why companies like Microsoft and Apple boldly embracing green energy. Former Vice President Al Gore’s firm, Generation Investment Management, showed this year in its annual Sustainability Trends Report that in two-thirds of the world, wind and solar power are the cheapest forms of energy during the coronavirus crisis. As our ESG team put it, “That means companies here in the United States have an opportunity to cut costs, reduce carbon emissions, and maximize operating efficiency.”

At the World Economic Forum’s annual meeting in Davos in January, Microsoft CEO Satya Nadella said, “The fundamental source of all value in capitalism still comes from the planet and the people who live on the planet, and if the planet is in danger, what happens to capitalism?”

We always must remember why we’re doing this: for stronger businesses, a more robust economy, and an equitable society

Friedman railed against any implication that businesses should exist as charities. Proponents of stakeholder capitalism agree with him – it’s just that the past 50 years have given us an excellent case study on what a singular focus on profits yields, and the evidence suggests a stronger alternative is possible. Profits enable companies to grow and benefit all of their stakeholders. But when corporate leaders and investors can capture the value, short- and long-term, of investments across workers, customers, communities, and the environment, in addition to shareholders, they can make decisions that strengthen their business for many years.

And that means a stronger economy, and a stronger country.